For the 24 hours to 23:00 GMT, the EUR declined 0.13% against the USD and closed at 1.1572 on Friday.

Macroeconomic news indicated that Euro-zone’s final services PMI dropped more than expected to a level of 54.2 in July, compared to a level of 55.2 in the prior month. The preliminary figures had indicated a drop to a level of 54.4, while market participants had envisaged the PMI to fall to a level of 54.4. On the other hand, the region’s seasonally adjusted retail sales rose for the second consecutive month by 0.3% on a monthly basis in June, driven by food sales and undershooting market expectations for an advance of 0.4%. Retail sales had registered a revised similar rise in the prior month.

Separately, in Germany, the final services PMI eased to a level of 54.1 in July, following a level of 54.5 in the previous month. Market participants had anticipated the PMI to decline to a level of 54.4. The preliminary figures had recorded a fall to 54.4.

In the US, non-farm payrolls advanced by 157.0K in July, undershooting market expectations for a rise of 193.0K. In the prior month, non-farm payrolls had registered a revised rise of 248.0K. Meanwhile, unemployment rate slid to an 18-year low rate of 3.9%, meeting market expectations. In the previous month, jobless rate had recorded a rate of 4.0%. Moreover, the nation’s average hourly earnings climbed 0.3% on a monthly basis in July, at par with market expectations. In the previous month, average hourly earnings had increased by a revised 0.1%. Further, trade deficit widened less than expected to $46.3 billion in June, from a revised trade deficit of $43.2 billion in the prior month. Markets had anticipated the nation to post a trade deficit of $46.5 billion.

On the contrary, data revealed that the final Markit services PMI eased to 56.0 in July, more than market expectations for a fall to a level of 56.2. The preliminary figures had indicated a fall to a level of 56.2. In the prior month, the PMI had registered a level of 56.5.

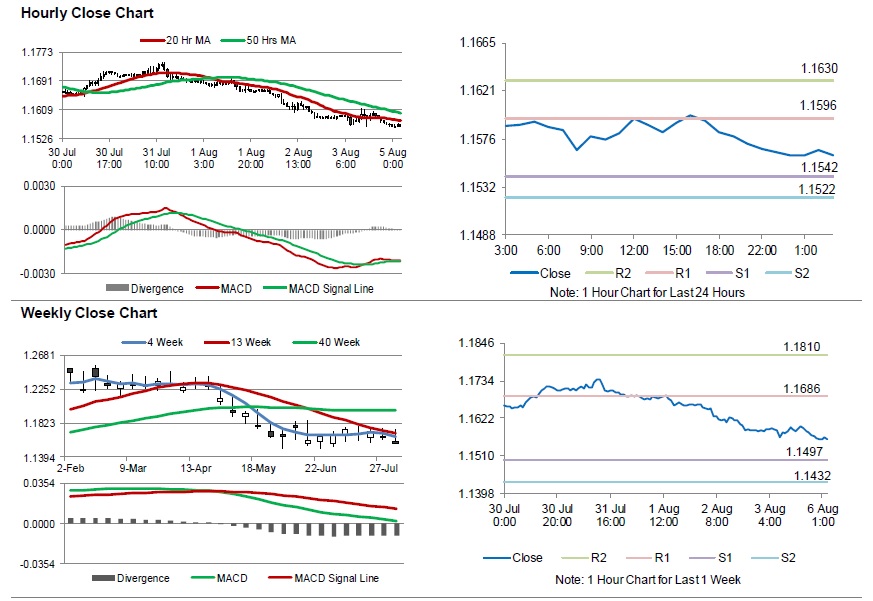

In the Asian session, at GMT0300, the pair is trading at 1.1561, with the EUR trading 0.10% lower against the USD from Friday’s close.

The pair is expected to find support at 1.1542, and a fall through could take it to the next support level of 1.1522. The pair is expected to find its first resistance at 1.1596, and a rise through could take it to the next resistance level of 1.1630.

Going forward, investors will keep an eye on the Eurozone’s Sentix investor confidence index for August, slated to release in a few hours. Additionally, Germany’s factory orders for June and the Markit construction PMI for July, slated to release in a while, will be on investors radar.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.