For the 24 hours to 23:00 GMT, the EUR declined 0.69% against the USD and closed at 1.0552.

Macroeconomic data released in the Euro-zone indicated that activity in the region’s services and manufacturing sector showed a strong performance in November, suggesting that economic growth in the common currency region is gathering momentum.

The flash Markit services PMI in the Euro-zone jumped more-than-expected to a level of 54.1 in November, notching its highest level in eleven months. The PMI had recorded a level of 52.8 in the previous month while markets anticipated it to rise to a level of 52.9. Moreover, growth in the region’s manufacturing sector unexpectedly advanced to a level of 53.7 in November, defying investor consensus for it to drop to a level of 53.3 and compared to a level of 53.5 in the prior month.

Elsewhere, in Germany, the flash Markit services PMI revealed that activity in Germany’s services sector accelerated to a six-month high in November, after it surprisingly jumped to a level of 55.0 in November, confounding market expectations for it to ease to a level of 54.0 and after recording a level of 54.2 in the prior month.

The US Dollar gained ground, after minutes of the Federal Reserve’s (Fed) most recent monetary policy meeting and robust economic data stepped up bets for an interest rate hike in December.

According to the FOMC minutes, most policymakers expressed a view that an interest-rate increase is warranted “relatively soon”, if incoming data continued to show an improving economy. However, few officials wanted to hold off on raising rates until it saw more progress on inflation and employment towards the central bank’s target, while others were ready to move in early November. Further, many officials voiced concerns that the US economic recovery could be at risk if the central bank waited too long to raise rates.

Another set of economic data showed that preliminary durable goods orders in the US jumped more-than-expected by 4.8% MoM in October, advancing at the fastest pace in a year, thus indicating that world’s largest economy is gaining steam in the fourth quarter. Durable goods registered a drop of 0.3% in the prior month while markets anticipated for a gain of 1.7%. Additionally, the nation’s preliminary Markit manufacturing PMI surprisingly increased to a level of 53.9 in November, recording its strongest reading in thirteen months, whereas investors had envisaged the index to remain steady at a level of 53.4, recorded in the previous month. Also, the nation’s final Reuters/Michigan consumer sentiment index jumped to six month high, after it rose to a level of 93.8 in November, suggesting that Americans became more optimistic about the nation’s growth prospects after Donald Trump won the US Presidential election. The index had recorded a level of 87.2 in the prior month, while registered a level of 91.6 in the preliminary figures. Additionally, mortgage applications in the US advanced by 5.5% in the week ended 18 November 2016, compared to a drop of 9.2% in the previous week. Moreover, the nation’s housing price index climbed by 0.6% MoM in September, in line with market expectations. In the prior month, the housing price index had registered a rise of 0.7%. Meanwhile, initial jobless claims climbed slightly more-than-estimated to a level of 251.0K in the week ended 19 November 2016, compared to a revised reading of 233.0K in the prior week. On the contrary, new home sales unexpectedly fell by 1.9% MoM, to a level of 563.0K in October, compared to a revised reading of 574.0K in the prior month and defying market consensus for the new home sales to rise to a level of 590.0K.

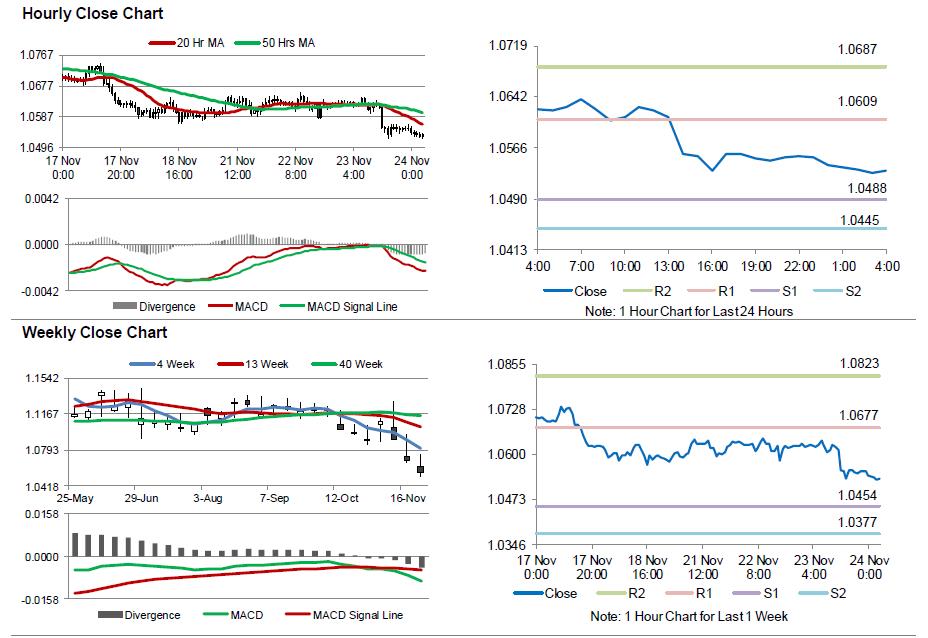

In the Asian session, at GMT0400, the pair is trading at 1.0532, with the EUR trading 0.19% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.0488, and a fall through could take it to the next support level of 1.0445. The pair is expected to find its first resistance at 1.0609, and a rise through could take it to the next resistance level of 1.0687.

Moving ahead, investors would closely monitor Germany’s GDP for 3Q 2016, GfK consumer confidence for December and Ifo expectations index for November, all slated to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.