For the 24 hours to 23:00 GMT, the EUR slightly rose against the USD and closed at 1.1297 on Friday.

Macroeconomic data showed that the Euro-zone’s seasonally adjusted trade surplus narrowed to €15.6 billion in December, amid decrease in exports and compared to market expectations for a surplus of €15.7 billion. The nation had posted a revised surplus of €15.8 billion in the previous month.

In the US, data showed that the preliminary Reuters/Michigan consumer sentiment index climbed to a level of 95.5 in February, following a reading of 91.2 in the prior month. Market participants had envisaged the index to advance to a level of 93.5. Moreover, the nation’s NY Empire State manufacturing index advanced to a level of 8.8 in February, surpassing market expectations for a rise to a level of 7.0. In the preceding month, the index had registered a reading of 3.9.

On the other hand, the US manufacturing production unexpectedly dropped by 0.9% on a monthly basis in January, led by losses in the automobile sector and defying market expectations for a steady reading. In the preceding month, manufacturing production had recorded a revised gain of 0.8%. Also, the industrial production surprisingly fell for the first time in eight months by 0.6% on a monthly basis in January, cofounding market consensus for a rise of 0.1%. Industrial production had registered a revised climb of 0.1% in the prior month.

In the Asian session, at GMT0400, the pair is trading at 1.1317, with the EUR trading 0.18% higher against the USD from Friday’s close.

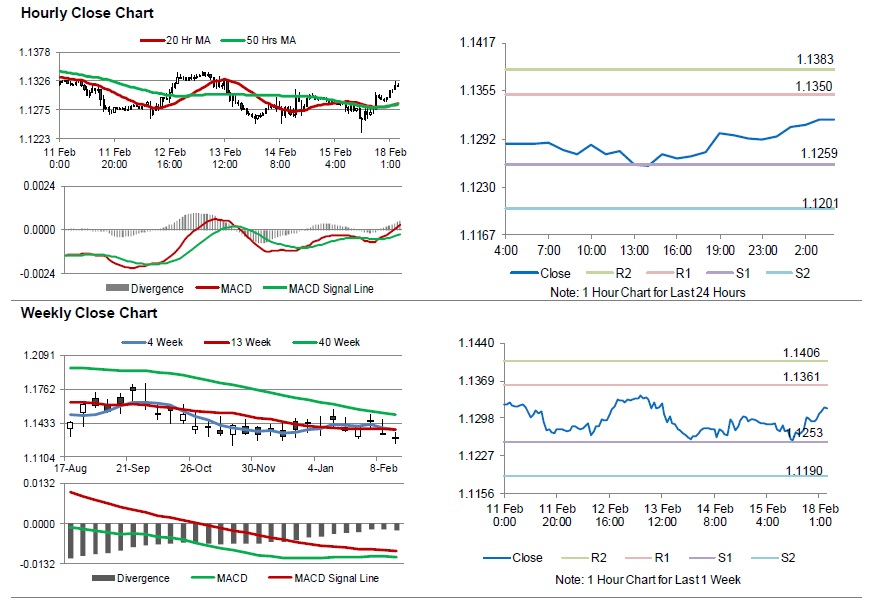

The pair is expected to find support at 1.1259, and a fall through could take it to the next support level of 1.1201. The pair is expected to find its first resistance at 1.1350, and a rise through could take it to the next resistance level of 1.1383.

Amid no major economic releases in the US and Euro-zone today, traders would focus on global macroeconomic events for further direction.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.