For the 24 hours to 23:00 GMT, the EUR declined 0.74% against the USD and closed at 1.0970 on Friday.

On the economic front, the Euro-zone’s seasonally adjusted trade surplus widened to a level of €23.3 billion in August, expanding for the first time since April, following a revised trade surplus of €20.8 billion in the prior month, while market anticipated the nation to post a trade surplus of €20.4 billion.

In the US, the Fed Chair, Janet Yellen, in a speech at a conference of policymakers and academics on Friday, noted that the US economic potential is slipping and may need aggressive steps to rebuild it. Further, she stated that it may be wise to run a “high pressure” economy with a tight labour market to reverse some of the negative effects of the Great Recession.

In other economic news, the US preliminary Reuters/Michigan confidence index unexpectedly declined to a one-year low level of 87.9 in October, amid uncertainty regarding the US Presidential election. Market expected the index to rise to a level of 91.8, after recording a reading of 91.2 in the previous month. On the contrary, the nation’s advance retail sales rebounded by 0.6% in September, in line with market expectations, pointing to robust demand, thus adding to expectations of a Fed interest rate hike later this year. In the prior month, advance retail sales recorded a drop of 0.2%. Also, the nation’s business inventories rose more-than-expected by 0.2% on a monthly basis in August, compared to a flat reading recorded in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.0976, with the EUR trading marginally higher from Friday’s close.

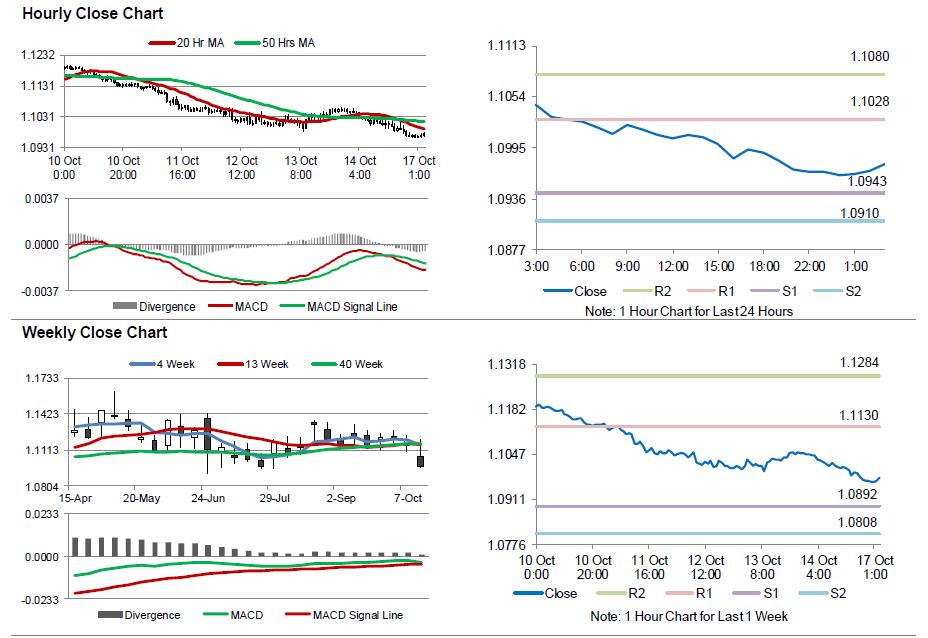

The pair is expected to find support at 1.0943, and a fall through could take it to the next support level of 1.0910. The pair is expected to find its first resistance at 1.1028, and a rise through could take it to the next resistance level of 1.1080.

Going ahead, investors would await a speech by the ECB President, Mario Draghi along with the Euro-zone’s consumer price index for September and Germany’s Buba monthly report, scheduled to release in a few hours. Moreover, in the US, industrial and manufacturing production for September, slated to release later today, would pique a lot of investor attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.