For the 24 hours to 23:00 GMT, the EUR rose 0.14% against the USD and closed at 1.1298.

On the data front, the Euro-zone’s seasonally adjusted trade surplus widened to a 11-month high level of €19.5 billion in February, following a revised surplus of €17.4 billion in the prior month. Moreover, the region’s consumer price index (CPI) advanced 1.4% on a yearly basis in March, in line with market expectations. In the previous month, the CPI had recorded a rise of 1.5%.

In the US, data showed that the US trade deficit narrowed to an 8-month low level of $49.4 billion in February, weighed down by decline in Chinese imports and compared to a deficit of $51.1 billion in the previous month. Market participants had envisaged the deficit to expand to $53.4 billion. Meanwhile, the nation’s mortgage applications dropped 3.5% on a weekly basis in the week ended 12 April 2019, following a fall of 5.6% in the previous week.

The Federal Reserve’s (Fed) latest Beige Book reported that the US economy expanded at a slight-to-moderate pace in March and early April, despite strong economic momentum in some districts. However, the report pointed that the labour markets continued to remain tight amid modest wage growth. On the outlook front, the Fed stated that there was little change in the economic outlook, with contacts in reporting districts expecting slight-to-modest growth in the months ahead.

In the Asian session, at GMT0300, the pair is trading at 1.1294, with the EUR trading a tad lower against the USD from yesterday’s close.

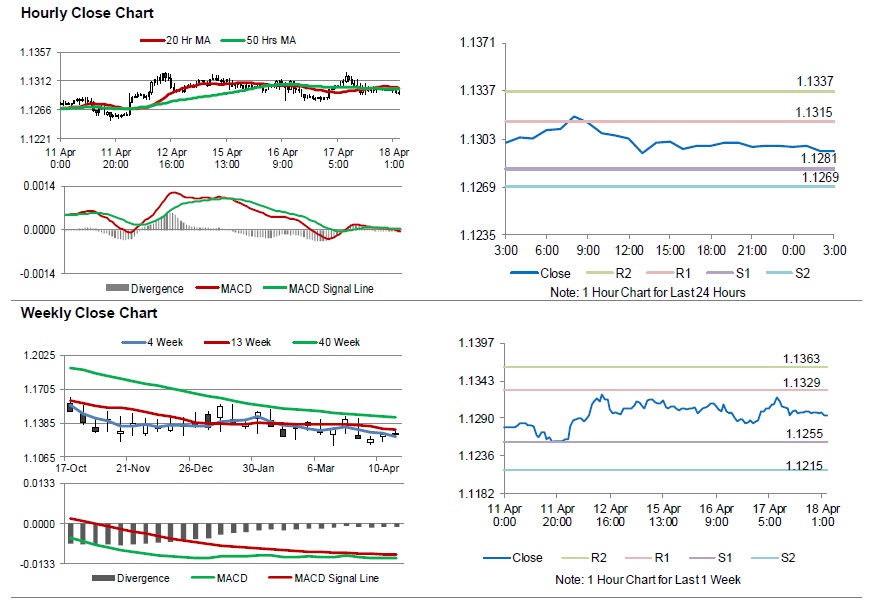

The pair is expected to find support at 1.1281, and a fall through could take it to the next support level of 1.1269. The pair is expected to find its first resistance at 1.1315, and a rise through could take it to the next resistance level of 1.1337.

Moving ahead, traders would await the Markit manufacturing and services PMI’s for April, set to release across the euro bloc. Later in the day, the US business inventories for February and advance retail sales for March, along with initial jobless claims will keep traders on their toes. Also the Philadelphia Fed business outlook and the Markit manufacturing and services PMI, all for April, will garner significant amount of investor attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.