For the 24 hours to 23:00 GMT, the EUR declined 0.23% against the USD and closed at 1.1195

after the European Central Bank’s President, Mario Draghi, pledged to ease the monetary policy or provide more asset purchases, if the inflation continues to deaccelerate further and deviate from its 2.0% target.

On the data front, the Euro-zone’s seasonally adjusted trade surplus narrowed to a 5-month low level of €15.3 billion in April, as exports dropped more than imports. The region had posted a revised surplus of €18.6 billion in the prior month, while markets had expected to post a surplus of €17.0 billion. Moreover, the ZEW economic sentiment index eased to a level of -20.2 in June, compared to a reading of -1.6 in the prior month. Meanwhile, the nation’s final consumer price index advanced 1.2% on an annual basis in May, in line with market expectations and confirming the preliminary print. In the prior month, the CPI had recorded a rise of 1.7%.

Separately, in Germany, the ZEW economic sentiment index unexpectedly declined to a 7-month low level of 21.1 in June, compared to market expectations for a fall to a level of -5.6. The index had registered a reading of -2.1 in the previous month. Further, the nation’s ZEW current situation index fell to a level of 7.8 in June, compared to a level of 8.2 in the preceding month. Market had anticipated the index to record a fall to a level of 6.1.

In the US, data showed that building permits advanced 0.3% on a monthly basis, to an annual rate of 1294.0K in May, surpassing market expectations for a reading of 1292.0K. In the prior month, building permits had recorded a revised reading of 1290.0K. Meanwhile, the US housing starts slid 0.9% on a monthly basis, to an annual rate of 1269.0K in May, compared to a revised level of 1281.0K in the prior month. Market participants had expected housing starts to record a decline to a level of 1239.0K.

In the Asian session, at GMT0300, the pair is trading at 1.1192, with the EUR trading a tad lower against the USD from yesterday’s close.

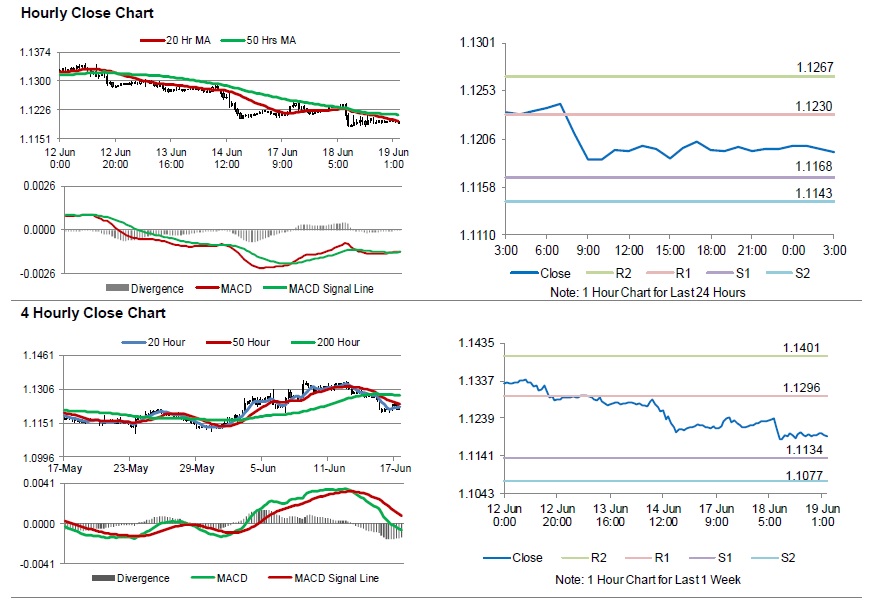

The pair is expected to find support at 1.1168, and a fall through could take it to the next support level of 1.1143. The pair is expected to find its first resistance at 1.1230, and a rise through could take it to the next resistance level of 1.1267.

Moving ahead, traders would keep an eye on the Euro-zone’s construction output for April along with Germany’s producer price index for May, slated to release in a few hours. Later in the day, the US Federal Reserve’s interest rate decision followed by the MBA mortgage applications, will keep traders on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.