For the 24 hours to 23:00 GMT, the EUR rose 0.5% against the USD and closed at 1.1953 on Friday.

On the macro front, the Euro-zone’s seasonally adjusted trade surplus narrowed more-than-expected to €18.6 billion in July, from a revised trade surplus of €21.7 billion in the previous month, while market participants were expecting the region to post a surplus of €20.3 billion.

The greenback lost ground against a basket of currencies, dragged down by a slew of downbeat economic reports from the US.

Data indicated that advance retail sales in the US unexpectedly fell 0.2% in August, dipping to a six-month low level, as sales were partially disrupted by impact of the Hurricane Harvey. Advance retail sales had climbed by a revised 0.3% in the previous month, whereas investors had envisaged for a gain of 0.1%. Moreover, the nation’s industrial production surprisingly declined 0.9% in August, dropping to a more than eight-year low level, as massive storm depressed the nation’s oil drilling, petroleum refining and other industrial activity. Markets had anticipated industrial production to rise 0.1%, after recording a revised rise of 0.4% in the prior month. Additionally, the nation’s manufacturing production recorded an unexpected drop of 0.3% in August, confounding market consensus for an increase of 0.3%. In the previous month, manufacturing production had recorded a revised flat reading.

In other economic news, the US flash Reuters/Michigan consumer sentiment index eased to a level of 95.3 in September, less than market expectations for a fall to a level of 95.0. In the prior month, the index had registered a reading of 96.8. Also, the nation’s New York Empire State manufacturing index slightly fell to a level of 24.4 in September, compared to a reading of 25.2 in the prior month. On the contrary, the nation’s business inventories rose 0.2% in July, in line with market expectations. In the previous month, business inventories had risen 0.5%.

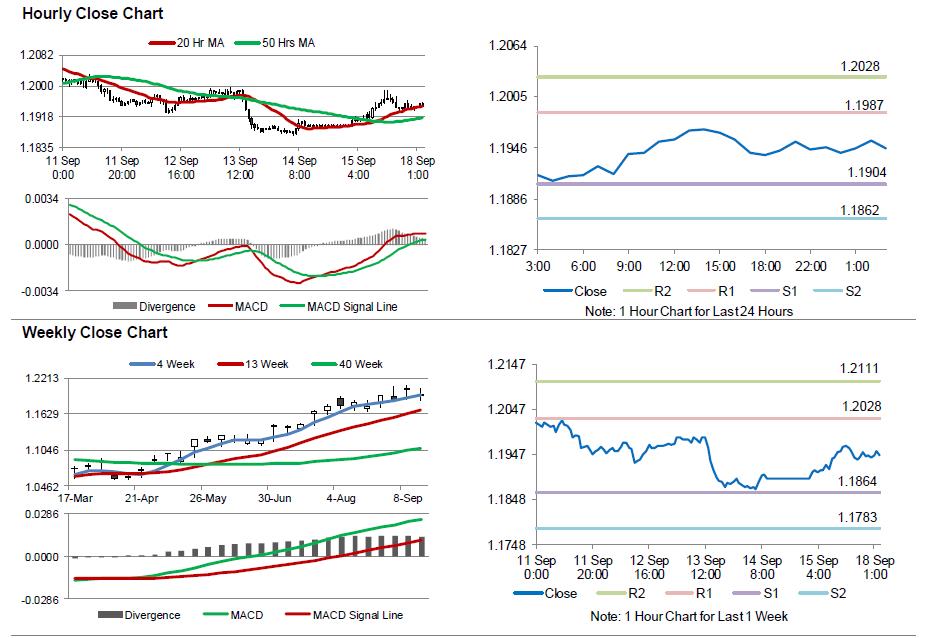

In the Asian session, at GMT0300, the pair is trading at 1.1945, with the EUR trading 0.07% lower against the USD from Friday’s close.

The pair is expected to find support at 1.1904, and a fall through could take it to the next support level of 1.1862. The pair is expected to find its first resistance at 1.1987, and a rise through could take it to the next resistance level of 1.2028.

Moving ahead, traders will focus on the Euro-zone’s final consumer price inflation data for August, slated to release in a few hours. Moreover, the US NAHB housing market index for September, scheduled to release later in the day, will be on investors’ radar.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.