For the 24 hours to 23:00 GMT, the EUR rose 0.21% against the USD and closed at 1.1710.

Macroeconomic data indicated that the Euro-zone’s seasonally adjusted trade surplus unexpectedly narrowed to €16.9 billion in May, after recording a revised trade surplus of €18.0 billion in the prior month, while markets participants were expecting the region’s trade surplus to widen to €18.6 billion.

In the US, data showed that advance retail sales climbed 0.5% on a MoM basis in June, rising for the 5th consecutive month. In the previous month, advance retail sales had registered a revised gain of 1.3%. Meanwhile, the nation’s business inventories rose 0.4% on a monthly basis in June, meeting market expectations. In the preceding month, business inventories had recorded a rise of 0.3%.

On the contrary, the US NY Empire State manufacturing index eased to a level of 22.6 in July, retreating from an 8-month high level of 25.0 in the previous month. Market consensus was for the index to fall to a level of 21.0.

In the Asian session, at GMT0300, the pair is trading at 1.1709, with the EUR trading slightly lower against the USD from yesterday’s close.

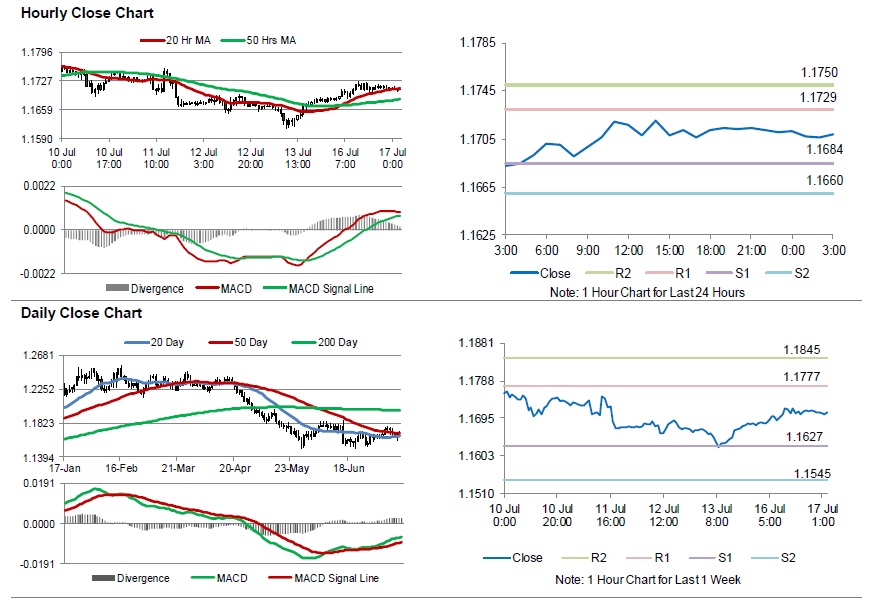

The pair is expected to find support at 1.1684, and a fall through could take it to the next support level of 1.1660. The pair is expected to find its first resistance at 1.1729, and a rise through could take it to the next resistance level of 1.1750.

Moving ahead, investors would closely monitor the US industrial production for May and the NAHB housing market index for July, due to be released later in the day. Also, the Federal Reserve Chairman, Jerome Powell’s testimony before the senate panel, will garner a significant amount of market attention.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.