For the 24 hours to 23:00 GMT, the EUR declined 0.18% against the USD and closed at 1.1775.

On the macro front, the Euro-zone’s seasonally adjusted trade surplus surprisingly widened to a record high of €25.0 billion in September, thus countering concerns about the impact of a stronger Euro on exporters. Market participants had anticipated the region’s trade surplus to remain steady at €21.0 billion.

The US Dollar trimmed some of its prior losses against other currencies, after a surprise rise in October retail sales as well as an uptick in consumer inflation cemented expectations for an interest rate hike in December.

Data showed that the US consumer price index (CPI) edged up 0.1% on a monthly basis in October, at par with market expectations, after jumping 0.5% in September. Further, the nation’s advance retail sales surprised to the upside, rising 0.2% MoM in October, offering further evidence of strength in US consumer spending. Investors had envisaged retail sales record a flat reading, after surging by a revised 1.9% in the prior month. Also, the nation’s MBA mortgage applications climbed 3.1% in the week ended 10 November, following a flat reading in the prior week.

Meanwhile, the nation’s business inventories remained flat in September, meeting market expectations. In the prior month, business inventories had registered a revised rise of 0.6%. On the other hand, the New York Empire State manufacturing index fell to a level of 19.4 in November, more than market consensus for a drop to a level of 25.1. The index had registered a reading of 30.2 in the prior month.

Meanwhile, the Federal Reserve (Fed) Bank of Boston President, Eric Rosengren, advocated for a December interest rate hike and stated that falling unemployment and sustained economic growth calls for gradual interest rate hikes.

In the Asian session, at GMT0400, the pair is trading at 1.1777, with the EUR trading marginally higher against the USD from yesterday’s close.

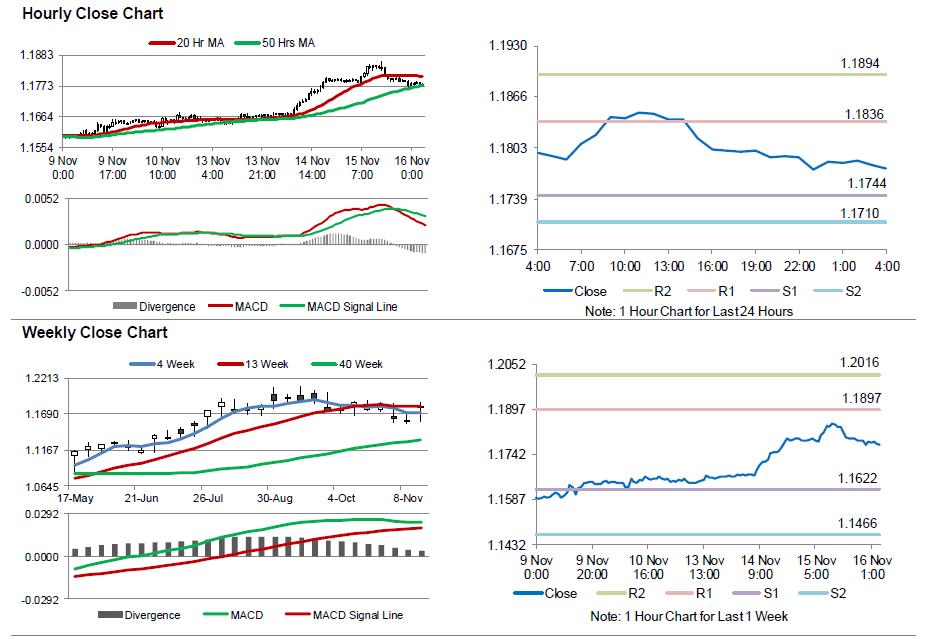

The pair is expected to find support at 1.1744, and a fall through could take it to the next support level of 1.1710. The pair is expected to find its first resistance at 1.1836, and a rise through could take it to the next resistance level of 1.1894.

Going ahead, traders would keep a close watch on the Euro-zone’s final inflation numbers for October, scheduled to release in a few hours. Later in the day, the release of US initial jobless claims followed by industrial and manufacturing production data for October as well as the NAHB housing market index for November, will pique significant amount of market attention.

The currency pair is trading below its 20 Hr moving average and showing convergence with its 50 Hr moving average.