For the 24 hours to 23:00 GMT, the EUR declined 0.24% against the USD and closed at 1.1768 on Friday, dragged by prolonged political uncertainty in Italy.

In economic news, the Euro-zone’s seasonally adjusted trade surplus widened more-than-expected to €21.2 billion in March, after recording a revised surplus of €20.9 billion in the previous month, while markets were expecting the region’s trade surplus to widen to €21.0 billion. Meanwhile, the region’s seasonally adjusted current account surplus narrowed to €32.0 billion in March, compared to a revised surplus of €36.8 billion in the prior month.

Separately, in Germany, the producer price index (PPI) index climbed 2.0% on an annual basis in April, higher than market expectations for a gain of 1.8%. In the prior month, the PPI had advanced 1.9%.

In the Asian session, at GMT0300, the pair is trading at 1.1749, with the EUR trading 0.16% lower against the USD from Friday’s close.

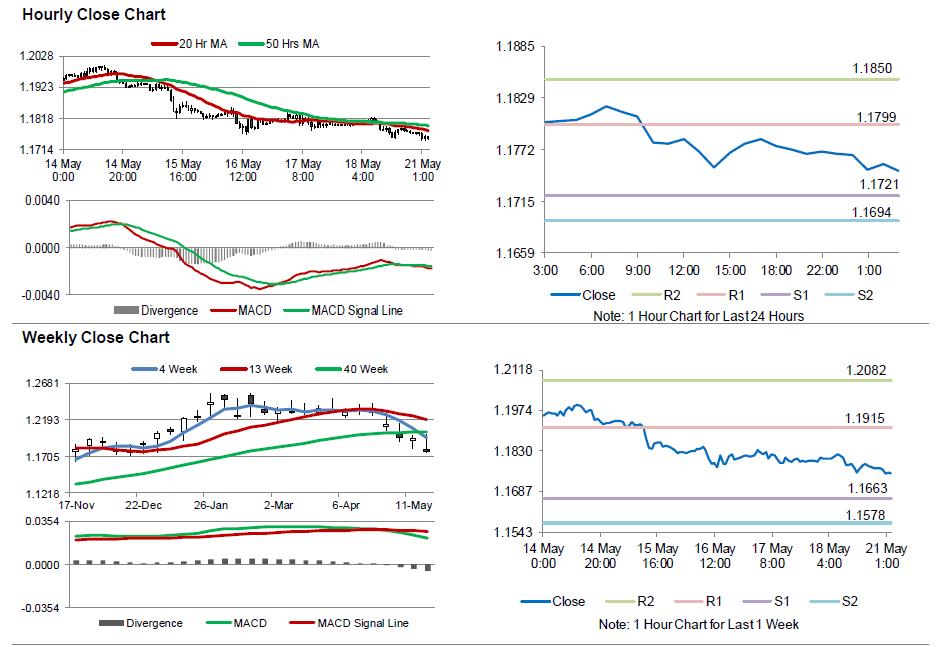

The pair is expected to find support at 1.1721, and a fall through could take it to the next support level of 1.1694. The pair is expected to find its first resistance at 1.1799, and a rise through could take it to the next resistance level of 1.1850.

Amid a lack of macroeconomic releases in the Euro-bloc today, investors would focus on the US Chicago Fed national activity index for April, slated to release later in the day.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.