For the 24 hours to 23:00 GMT, the EUR rose 0.57% against the USD and closed at 1.2264, after the Euro-zone’s seasonally adjusted trade surplus widened more-than-expected to €22.5 billion in November, amid an increase in exports, thus countering concerns about the impact of a stronger Euro on exporters. The region had recorded a surplus of €19.0 billion in the previous month, while markets were anticipating for a surplus of €22.3 billion.

In the Asian session, at GMT0400, the pair is trading at 1.2258, with the EUR trading marginally lower against the USD from yesterday’s close.

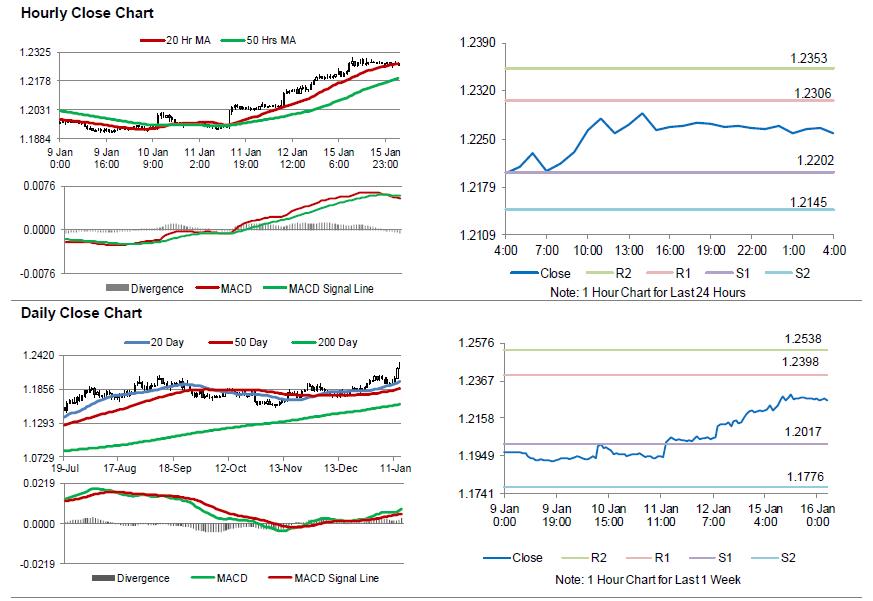

The pair is expected to find support at 1.2202, and a fall through could take it to the next support level of 1.2145. The pair is expected to find its first resistance at 1.2306, and a rise through could take it to the next resistance level of 1.2353.

Going ahead, traders would look forward to Germany’s final inflation numbers for December, scheduled to release in a few hours. Moreover, the New York Empire State manufacturing index for January, scheduled to release later in the day, would be on investors’ radar.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.