For the 24 hours to 23:00 GMT, the EUR rose 0.32% against the USD and closed at 1.2498, after Euro-zone’s seasonally adjusted trade surplus widened more-than-expected to €23.8 billion in December, driven by a rise in exports. The region had recorded a revised surplus of €22.0 billion in the previous month, while markets were anticipating for a surplus of €22.3 billion.

The US Dollar declined against a basket of major currencies, as mixed US economic reports dampened expectations for a more aggressive rate hike policy by the Federal Reserve. On the macroeconomic front, data showed that industrial production in the US unexpectedly dropped 0.10% in January, due to a sharp decline in mining output. In the prior month, industrial production recorded a revised rise of 0.40%. Markets were anticipating industrial production to climb 0.20%. Moreover, the number of Americans filing for fresh jobless claims rose to a level of 230.0K in the week ended 10 February 2018, compared to a revised reading of 223.0K in the prior week. Market had anticipated the initial jobless claims to climb to a level of 228.0K.

On the other hand, the NAHB housing market index remained steady at 72.00 in February, at par market expectations. Additionally, manufacturing production remained flat on a monthly basis in January, less than market expectations for a rise of 0.30%. In the prior month, manufacturing production had advanced 0.10%.

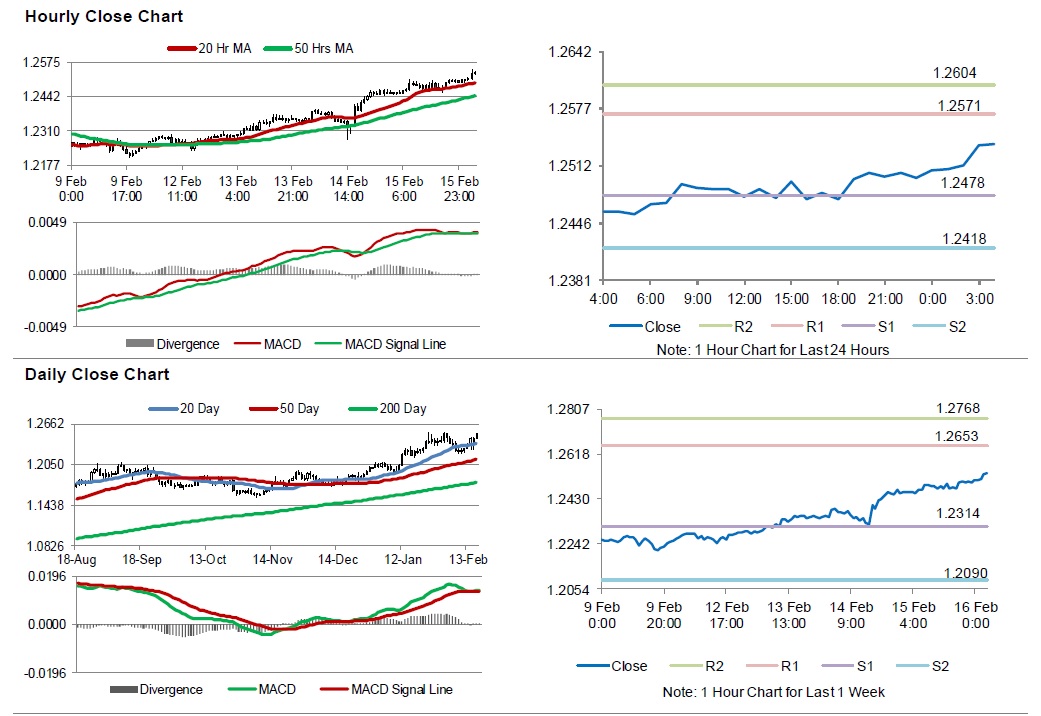

In the Asian session, at GMT0400, the pair is trading at 1.2537, with the EUR trading 0.31% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.2478, and a fall through could take it to the next support level of 1.2418. The pair is expected to find its first resistance at 1.2571, and a rise through could take it to the next resistance level of 1.2604.

In absence of crucial macroeconomic releases in the Euro-zone today, investors would keep a close watch on US housing starts and building permits data for January, followed by the flash University of Michigan consumer sentiment index for February, all slated to release later in the day.

The currency pair is trading above its 20 Hr and 50 Hr moving average.