For the 24 hours to 23:00 GMT, the EUR rose 1.00% against the USD and closed at 1.1680 on Friday.

In the economic news, the Euro-zone’s preliminary consumer price index climbed 2.0% on an annual basis in June, at par with market expectations. The index had risen by 1.9% in the prior month.

Further, Germany’s retail sales data unexpectedly dropped 1.6% on an annual basis in May, defying market expectations for a rise of 1.8%. In the previous month, retail sales had increased by a revised 1.0%. Meanwhile, the nation’s unemployment rate remained steady at 5.2% in June, meeting market expectations.

In the US, data released showed that, personal spending rose 0.2% on a monthly basis in May, falling short of market anticipation for an increase of 0.4%. Personal spending had advanced by a revised 0.5% in the previous month. Meanwhile, personal income rose 0.4% on a monthly basis in May, in line with market expectations and compared to a revised gain of 0.2% in the prior month.

Moreover, the nation’s Chicago Fed purchasing managers index unexpectedly jumped to a 6-month high level of 64.1 in the US, cofounding market expectations for a fall to 60.0. The index had recorded a level of 62.7 in the preceding month.

Additionally, the US final Reuters/Michigan consumer sentiment index climbed to 98.2 in June, less-than-market expectations for an advance to 99.0. In the previous month, the index had registered a reading of 98.0 and the preliminary figures had indicated a rise to 99.3.

In the Asian session, at GMT0300, the pair is trading at 1.1656, with the EUR trading 0.21% lower against the USD from Friday’s close.

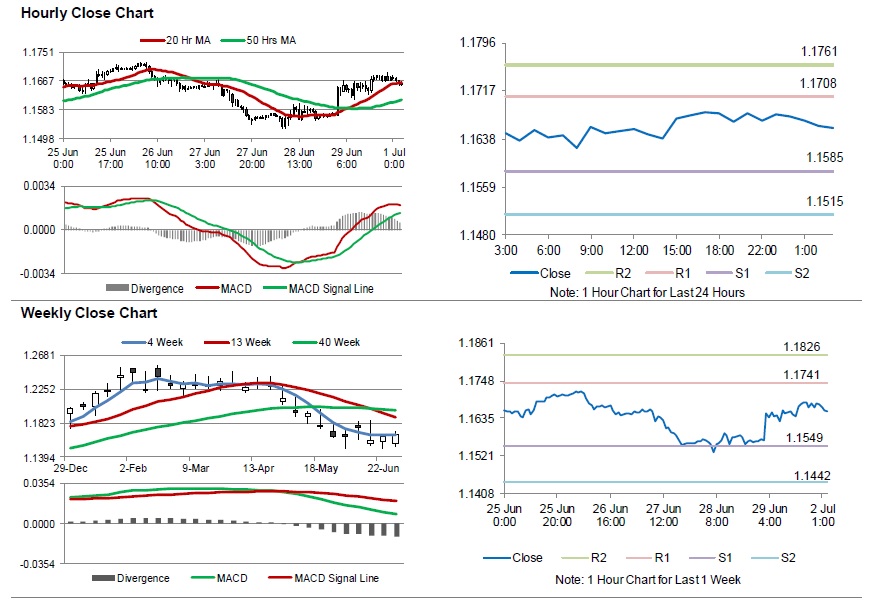

The pair is expected to find support at 1.1585, and a fall through could take it to the next support level of 1.1515. The pair is expected to find its first resistance at 1.1708, and a rise through could take it to the next resistance level of 1.1761.

Moving ahead, investors would closely monitor the flash Markit manufacturing PMI for June, slated to release across the euro bloc in a few hours. Also, Euro-zone’s producer price index and unemployment rate, both for May, due to release in a few hours will keep the investors on their toes. Later in the day, the US Markit manufacturing PMI for June and construction spending data for May, would pique significant amount of investor attention.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.