For the 24 hours to 23:00 GMT, the EUR rose 0.21% against the USD and closed at 1.3626, as Euro-zone’s unemployment rate surprisingly fell to 11.7% in April, the lowest level in 18 months. However, the annual consumer inflation rate in the Euro-bloc eased to 0.5% in May, defying analysts’ expectations for consumer prices to remain at April month’s level of 0.7%. Meanwhile, data from Euro-zone’s member nations showed that Italy’s unemployment rate remained stubbornly high at 12.6% in April while unemployment in Spain decreased by 111,916 in May.

In the US, the Kansas City Fed President, Esther George, urged the central bank to make provisions for shrinking its balance sheet before raising its interest rates, which according to her should be raised “sooner and at a faster pace.” Separately, the Dallas Fed President, Richard Fisher, in a telephone interview with Reuters, highlighted his support for the Fed to end its QE programme in October even as he does not expected the US central bank to raise its short-term rates this year.

On the economic front, US factory orders rose more-than-expected 0.7% (MoM) for a third straight month in April, compared to a revised gain of 1.5% in March.

In a noteworthy event, the World Bank Managing Director, Bertrand Badre indicated that the bank does not expect a major change in its global growth forecast of 3.2% this year, as, according to him, developed economies are doing better despite a harsh winter in the US and a prolonged period of low inflation in the Euro-zone.

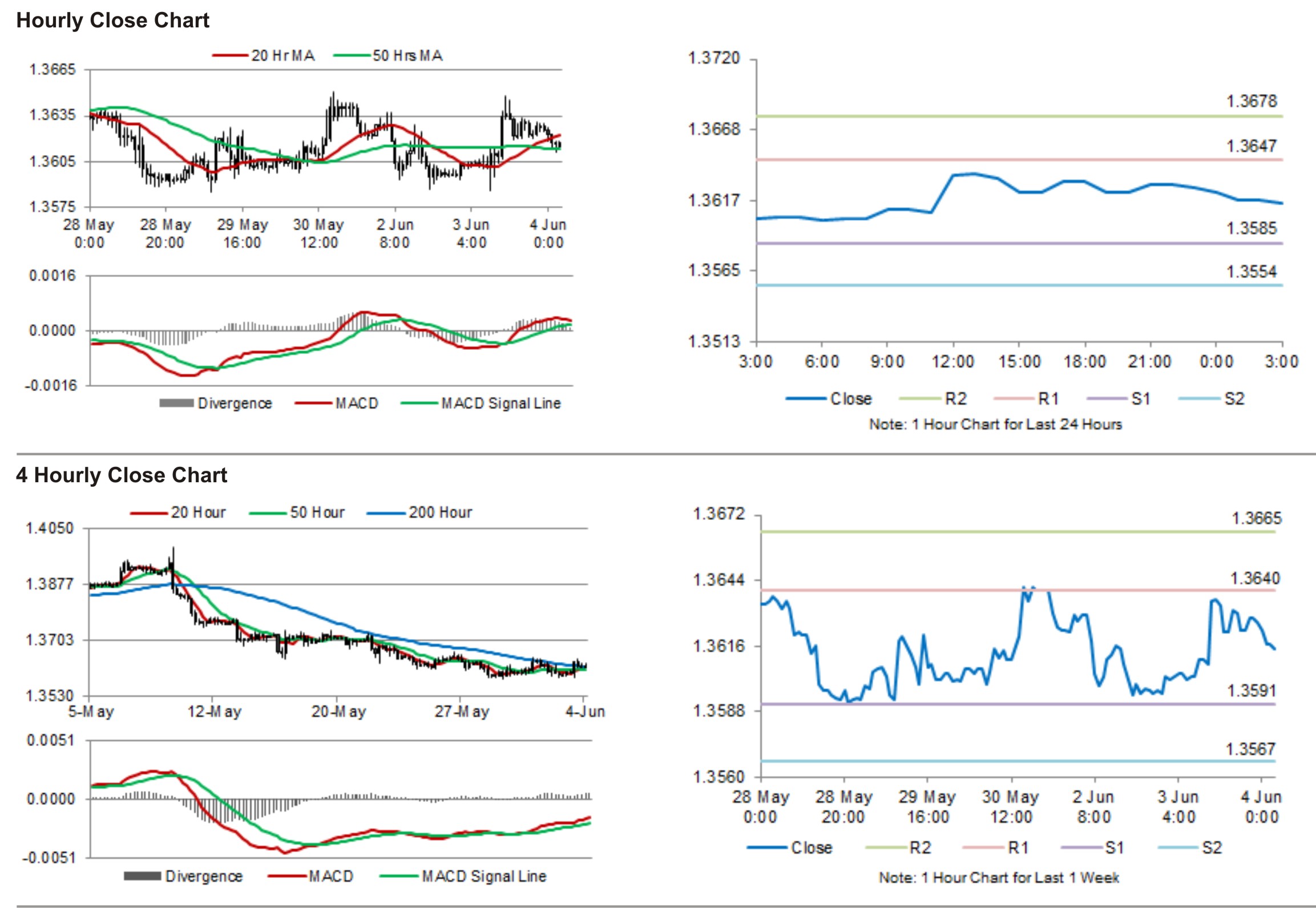

In the Asian session, at GMT0300, the pair is trading at 1.3615, with the EUR trading 0.08% lower from yesterday’s close.

The pair is expected to find support at 1.3585, and a fall through could take it to the next support level of 1.3554. The pair is expected to find its first resistance at 1.3647, and a rise through could take it to the next resistance level of 1.3678.

Later today, traders would keenly eye Euro-zone’s first quarter GDP data, along with Markit service PMI report for the Euro-zone and its member nations, including Germany and France.

The currency pair is trading just below its 20 Hr moving average and is showing convergence with its 50 Hr moving average.