For the 24 hours to 23:00 GMT, the EUR rose 0.86% against the USD and closed at 1.1552.

On macro front, the Euro-zone’s unemployment rate unexpectedly tumbled to decade low level of 7.9% in November, compared to a revised reading of 8.0% in the prior month. Market participants had envisaged the unemployment rate to advance to 8.1%.

Separately, in Germany, the seasonally adjusted trade surplus widened to €19.0 billion in November, more than market expectations for a surplus of €18.0 billion. In the previous month, the nation had posted a revised surplus of €17.9 billion.

In the US, data indicated that the US mortgage applications rebounded 23.5% on a weekly basis in the week ended 04 January 2019, following a decline of 8.5% in the preceding week.

The minutes of the FOMC December monetary policy meeting showed that policymakers would remain patient on further interest rate increases, due to volatility in financial markets and concerns over global economic growth. Further, the officials expressed uncertainty over the timing of future rate increases. Additionally, the Fed lowered its interest rate projection for 2019 to two from three.

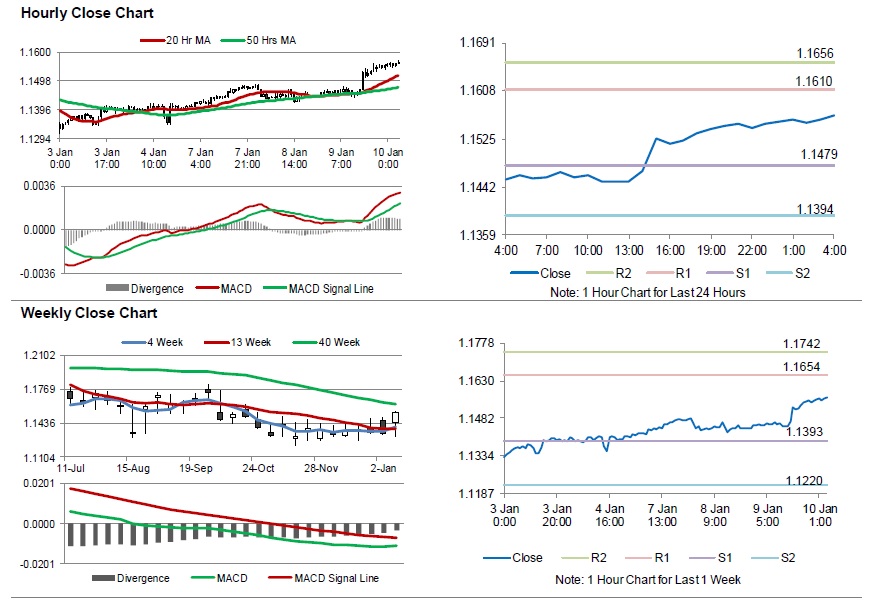

In the Asian session, at GMT0400, the pair is trading at 1.1565, with the EUR trading 0.11% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1479, and a fall through could take it to the next support level of 1.1394. The pair is expected to find its first resistance at 1.1610, and a rise through could take it to the next resistance level of 1.1656.

Amid lack of macroeconomic releases in the Euro-zone today, traders would keep an eye on the US initial jobless claims along with the Federal Reserve Chairman, Jerome Powell’s speech, due later in the day.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.