For the 24 hours to 23:00 GMT, the EUR declined 0.09% against the USD and closed at 1.0666.

On the macro front, the Euro-zone’s unemployment rate fell to 9.5% in February, meeting market expectations and hitting its lowest level in nearly eight years, thus chiming with other signs that the common currency region is regaining momentum. The region’s unemployment rate had registered a reading of 9.6% in the previous month. Additionally, the region’s manufacturing sector growth was confirmed at a nearly seven-year high level of 56.2 in March, meeting market expectations. In the prior month, the PMI had recorded a level of 55.4.

Elsewhere, Germany’s final Markit manufacturing PMI rose to a level of 58.3 in March, confirming the preliminary figures and following a reading of 56.8 in the previous month.

In the US, the ISM manufacturing PMI eased to a level of 57.2 in March, meeting market expectations and falling from a more than two-year high level of 57.7 registered in the preceding month, suggesting that growth in the nation’s manufacturing sector is losing some steam. Also, the nation’s Markit manufacturing PMI was unexpectedly revised lower to a level of 53.3 in March, from a reading of 53.4 recorded in the preliminary print. The PMI had registered a reading of 54.2 in the previous month, whereas markets expected for a fall to a level of 53.5.

In contrast, the nation’s construction spending rebounded 0.8% MoM in February, surging to its highest level in nearly eleven years, amid robust gains in home building investment. Construction spending had recorded a revised drop of 0.4% in the prior month.

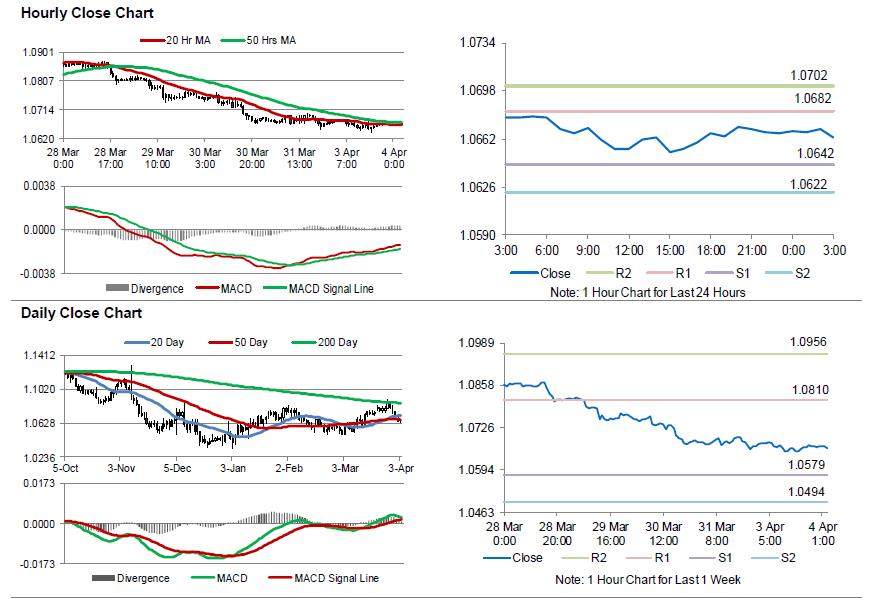

In the Asian session, at GMT0300, the pair is trading at 1.0663, with the EUR trading marginally lower against the USD from yesterday’s close.

The pair is expected to find support at 1.0642, and a fall through could take it to the next support level of 1.0622. The pair is expected to find its first resistance at 1.0682, and a rise through could take it to the next resistance level of 1.0702.

Moving ahead, investors will look forward to the Euro-zone’s retail sales data for February and a speech by the ECB President, Mario Draghi, due in a few hours. Moreover, in the US, trade balance figures, factory orders and final durable goods orders, all for February, scheduled to release later in the day, will keep investors on their toes.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.