For the 24 hours to 23:00 GMT, the EUR declined 0.14% against the USD and closed at 1.0868, following mixed economic data in the Euro-zone.

Data showed that Euro-zone’s unemployment rate surprisingly fell to its lowest level since August 2011, after it declined to 10.3% in January. Markets expected it to remain steady at 10.4%. Additionally, the region’s final Markit manufacturing PMI unexpectedly rose to a level of 51.2 in February, registering its lowest reading in a year, compared to market expectations for it to remain steady at 51.0. Meanwhile, Germany’s seasonally adjusted unemployment rate remained steady at 6.2% in February. On the other hand, the nation’s final Markit manufacturing PMI surprisingly advanced to a level of 50.5 in February, while markets expected it to remain steady at 50.2.

In the US, the ISM manufacturing PMI advanced more-than-expected to a level of 49.5 in February, compared to market expectations for a rise to a level of 48.5 and following a reading of 48.2 in the preceding month. However, it remained in contraction territory for the fifth straight month. Additionally, the nation’s construction spending rose more-than-expected by 1.5% MoM in January, recording its highest level in more than eight-years, showing signs that the nation’s economy is regaining momentum. It recorded a revised gain of 0.6% in the previous month. Markets were anticipating it to climb by 0.3%. Also, the nation’s final Markit manufacturing PMI rose more-than-expected to a level of 51.3 in February, whereas markets expected it to rise to a level of 51.2 and compared to a preliminary reading of 51.0.

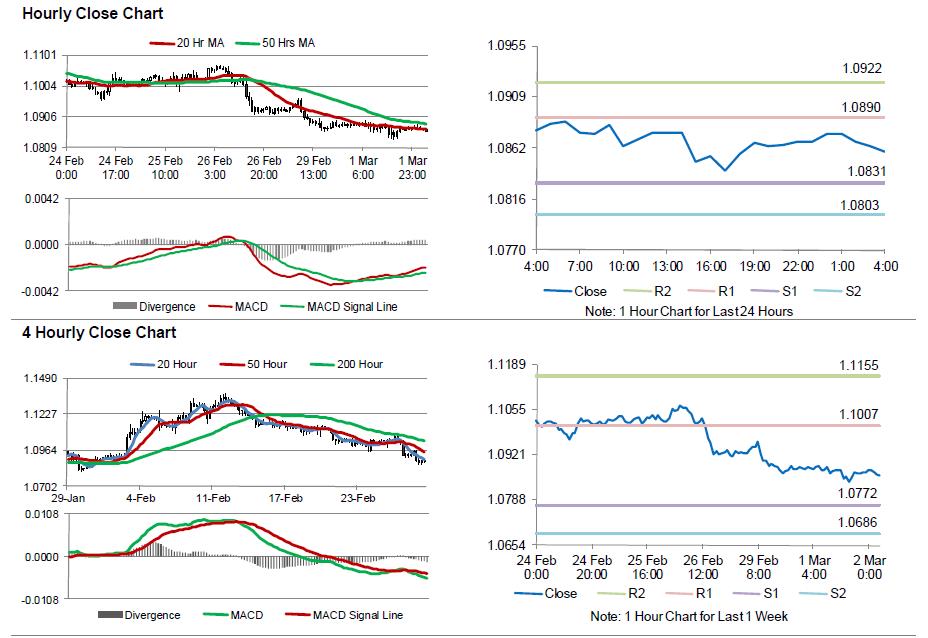

In the Asian session, at GMT0400, the pair is trading at 1.0859, with the EUR trading 0.09% lower from yesterday’s close.

The pair is expected to find support at 1.0831, and a fall through could take it to the next support level of 1.0803. The pair is expected to find its first resistance at 1.0890, and a rise through could take it to the next resistance level of 1.0922.

Looking ahead, investors await the release of Euro-zone’s producer price index data, slated to be released in a few hours. Additionally, the US Fed’s Beige book report and ADP employment data, scheduled later today, will grab a lot of market attention.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.