For the 24 hours to 23:00 GMT, the EUR rose 0.16% against the USD and closed at 1.1353.

On the data front, the Euro-zone’s seasonally adjusted construction output dropped 1.4% on a monthly basis in January. In the preceding month, construction output had recorded a revised gain of 1.1%. Meanwhile, the region’s ZEW economic sentiment index improved to -2.5 in March. In the prior month, the index had recorded a level of -16.6.

Separately, in Germany, the ZEW economic sentiment index rose to a 1-year high level of -3.6 in March, compared to market consensus for a rise to a level of -11.0. The index had recorded a level of -13.4 in the previous month. However, the nation’s current situation index declined to a level of 11.1 in March, compared to a level of 15.0 in the prior month. Market participants had envisaged the index to fall to a level of 11.7.

The US dollar declined against major currencies, amid expectations that the Federal Reserve (Fed) will hold the interest rate steady in the upcoming monetary policy meeting.

In the US, data showed that factory orders climbed 0.1% on a monthly basis in January, following a similar rise in the previous month. Markets had anticipated for factory orders to advance 0.3%. Additionally, the nation’s final durable goods orders advanced 0.3% on a monthly basis in January, less than the preliminary reading and compared to a gain of 1.2% in the previous month. Market participants had expected durable goods orders to advance 0.4%.

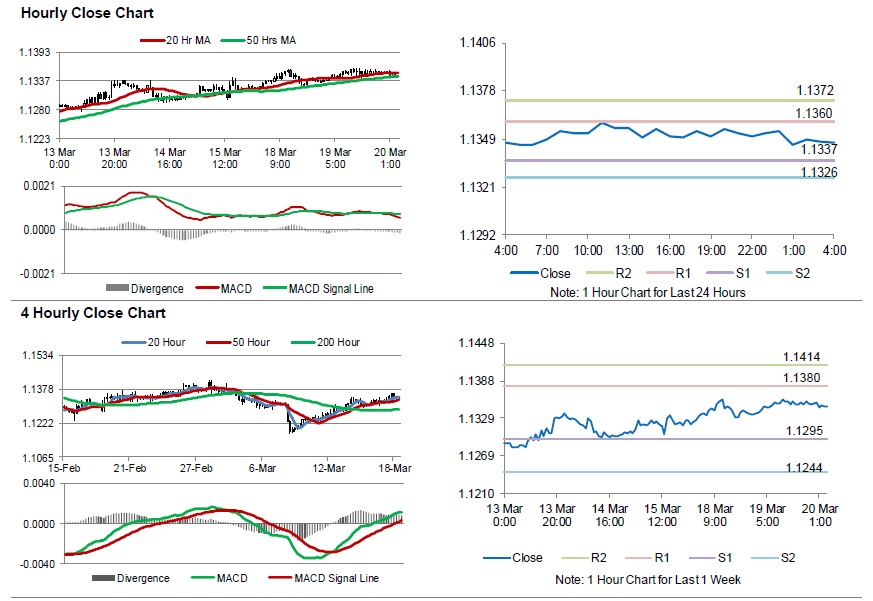

In the Asian session, at GMT0400, the pair is trading at 1.1347, with the EUR trading 0.05% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.1337, and a fall through could take it to the next support level of 1.1326. The pair is expected to find its first resistance at 1.1360, and a rise through could take it to the next resistance level of 1.1372.

Going forward, traders would await Germany’s producer price index for February, slated to release in a few hours. Later in the day, the FOMC interest rate decision along with the US MBA mortgage applications will be on investors’ radar.

The currency pair is trading below with its 20 Hr moving average and showing convergence its 50 Hr moving average.