For the 24 hours to 23:00 GMT, the EUR declined 0.07% against the USD and closed at 1.0632.

On the data front, the Euro-zone’s ZEW economic sentiment index advanced more-than-expected to a level of 18.1 in December, indicating that investors remained optimistic about the region’s economic outlook. In the prior month, the economic sentiment index had registered a reading of 15.8.

Meanwhile, Germany’s ZEW economic sentiment index surprisingly remained steady at a level of 13.8 in December, defying market expectations for a rise to a level of 14.0. Further, the current situation index jumped to its highest level in more than a year of 63.5 in December, surpassing market expectations of a rise to a level of 59.0 and after recording a reading of 58.8 in the prior month. Also, the nation’s final consumer price index held steady at a two-year high of 0.8% YoY in November, meeting preliminary estimates and compared to a similar rise in the prior month.

In economic news, data indicated that the US NFIB small business optimism index advanced to a level of 98.4 in November, notching its highest level since 2009. Markets expected the index to rise to a level of 96.7, after registering a reading of 94.9 in the previous month.

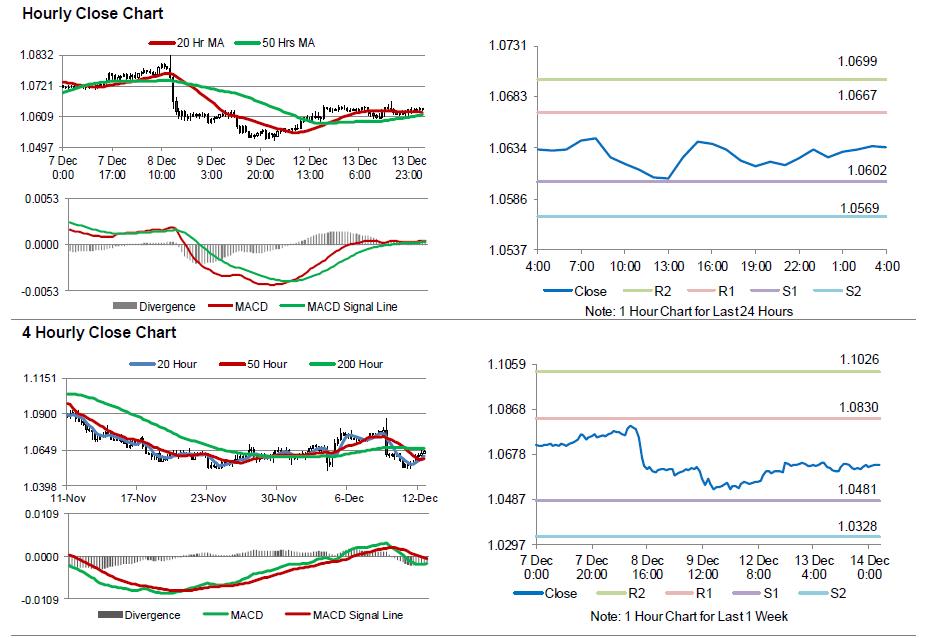

In the Asian session, at GMT0400, the pair is trading at 1.0635, with the EUR trading marginally higher against the USD from yesterday’s close.

The pair is expected to find support at 1.0602, and a fall through could take it to the next support level of 1.0569. The pair is expected to find its first resistance at 1.0667, and a rise through could take it to the next resistance level of 1.0699.

Going ahead, investors will look forward to the Euro-zone’s industrial production data for October, scheduled to release in a few hours. Moreover, market participants turned their attention to the outcome of Federal Reserve’s monetary policy meeting, amid widespread expectations for an interest rate hike. Additionally, a raft of economic releases in the US, consisting of retail sales, industrial and manufacturing (SIC) production, all scheduled to release later today, would pique investor attention.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.