For the 24 hours to 23:00 GMT, the EUR declined 0.19% against the USD and closed at 1.1012.

On the data front, Euro-zone’s ZEW economic sentiment index unexpectedly climbed to a level of -1.0 in November, defying market expectations for a fall to a level of -32.5. The index had recorded a reading of -23.5 in the prior month.

Separately, in Germany, the ZEW economic sentiment index rose to a level of -2.1 in in November, more than market expectations for an increase to a level of -13.0. The index had recorded a reading of -22.8 in the previous month. Moreover, the nation’s current situation index advanced to a level of -24.7 in November, less than market expectations of a rise to a level of

-22.0. In the prior month, the index had recorded a reading of -25.3.

In the US, data showed that the NFIB small business optimism index advanced to a level of 102.4 in October. Markets had expected the index to record a rise to a level of 103.5. The index had registered a reading of 101.8 in the prior month.

In the Asian session, at GMT0400, the pair is trading at 1.1013, with the EUR trading a tad higher against the USD from yesterday’s close.

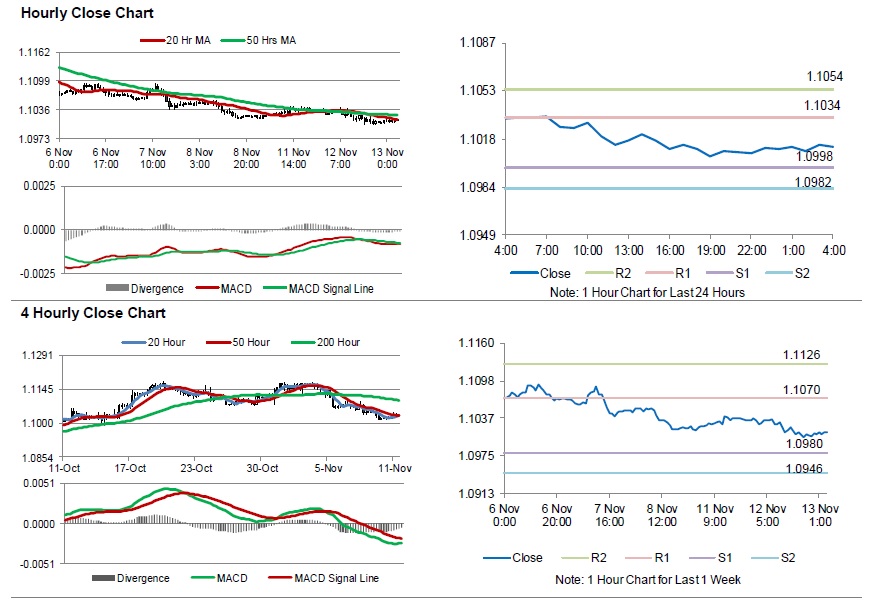

The pair is expected to find support at 1.0998, and a fall through could take it to the next support level of 1.0982. The pair is expected to find its first resistance at 1.1034, and a rise through could take it to the next resistance level of 1.1054.

Going forward, traders would keep an eye on Euro-zone’s industrial production for September followed by Germany’s consumer price index for October, set to release in a few hours. Later in the day, the US consumer price index and monthly budget statement, both for October along with the MBA mortgage applications, will pique significant amount of investors’ attention. Additionally, the US Federal Reserve (Fed) Chairman, Jerome Powell’s testimony, due to release later today, will keep investors on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.