For the 24 hours to 23:00 GMT, EUR rose 0.42 % against the USD and closed at 1.3761.

The US Dollar declined against the Euro after the relentless cold weather weighed on the US manufacturing and housing index in the month of February. Yesterday, the New York Empire State manufacturing index declined more-than-expected to a reading of 4.48 in February, from a level of 12.51 recorded in the previous month. Separately, the US NABH housing market index also slumped to a level of 46.0 in February, confounding analysts who had expected the index to remain unchanged at previous month’s level of 56.0.

Meanwhile in the Euro-zone, the ECB Executive Board Member, Peter Praet lauded the central bank’s accommodative monetary policy in playing a big role in bringing the region’s economy back on track. However, he stressed that the onus was now on the governments of the respective countries to embrace structural reforms in order to boost growth in the area. Furthermore, he assured that the central bank would maintain the accommodative monetary policy for as long as needed.

On the economic front, on a non-seasonally adjusted basis, current account surplus in the Euro-zone widened to €33.2 billion in December, compared to a surplus of €27.2 billion registered in the preceding month. Separately, the ZEW reported that its index on the Euro-zone economic sentiment unexpectedly declined to a reading of 68.5 in February, from a reading of 73.3 recorded in the preceding month. Likewise, the ZEW survey of economic sentiment in Germany also registered a fall to a reading of 55.7 in February, from previous month’s level of 61.7. However, the ZEW survey for current economic situation in Germany rose more-than-expected to a figure of 50.0 in February, from a level of 41.2 witnessed in January.

In the Asian session, at GMT0400, the pair is trading at 1.3764, with the EUR trading tad higher from yesterday’s close.

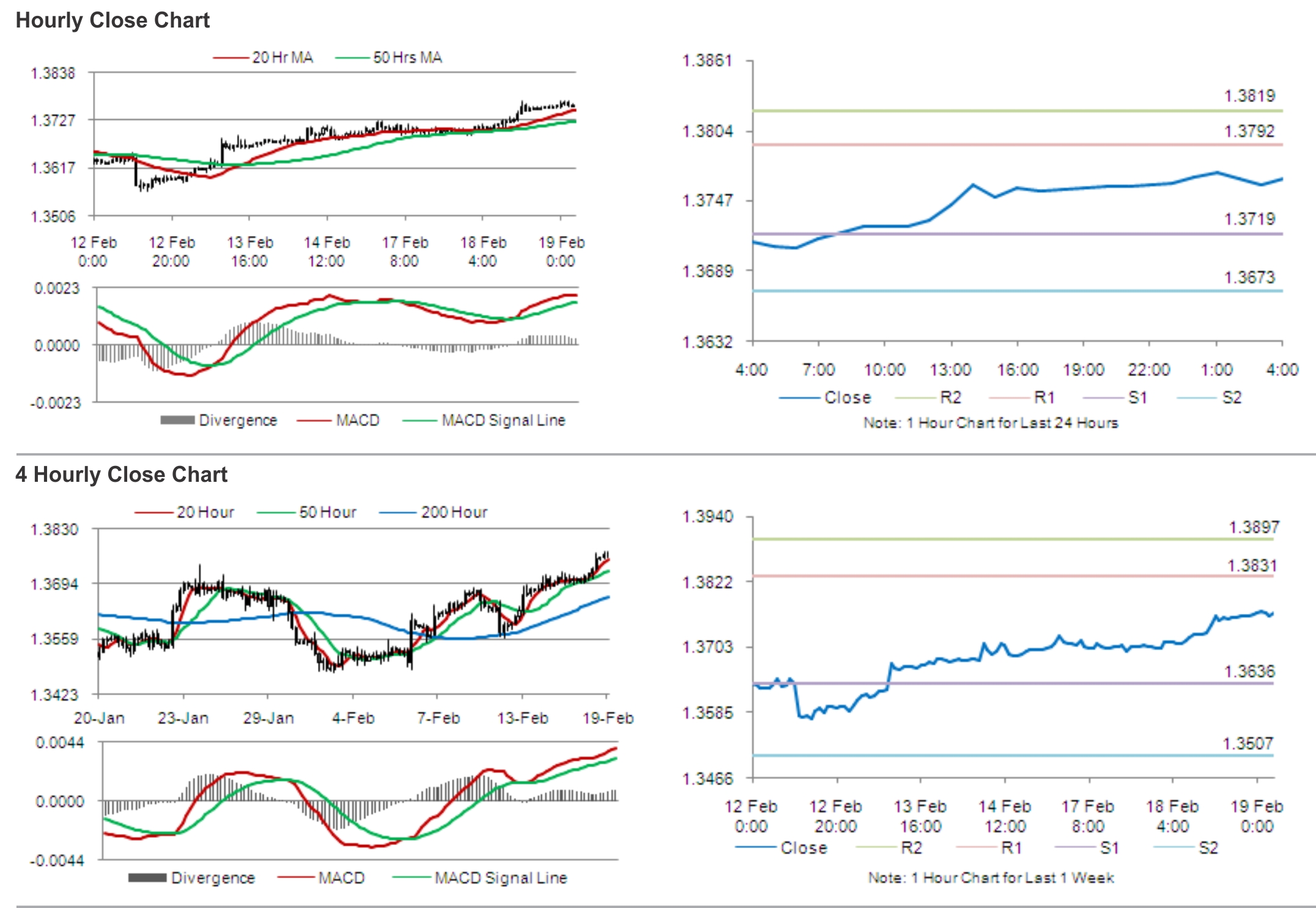

The pair is expected to find support at 1.3719, and a fall through could take it to the next support level of 1.3673. The pair is expected to find its first resistance at 1.3792, and a rise through could take it to the next resistance level of 1.3819.

Later today, traders would keep an eye on the Euro-zone’s construction output data and the outcome of Germany’s 10-year bond auction.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.