For the 24 hours to 23:00 GMT, the EUR declined 0.86% against the USD and closed at 1.0918.

Yesterday, the European Commission, in its first economic forecasts since the Brexit vote, raised the Euro-zone’s growth projection for this year but slashed 2017 growth forecast, citing increased political uncertainty, including Britain’s decision to leave the European Union and weakening global trade.

The Commission projected the Euro-zone to grow by a modest 1.7% this year, from 1.6% estimated earlier in May, while the growth projection for next year was trimmed to 1.5%, from 1.8%. Further, the commission forecasted that inflation in the common currency region would hit 1.4% in both 2017 and 2018, after rising to 0.3% this year, thus offering some signs of relief to the European Central Bank (ECB) which is struggling to spur inflation in the common currency region.

The US Dollar rebounded sharply against most of its peers, after investors digested the shock of Donald Trump pulling off a stunning victory in the US Presidential election.

In other economic news, mortgage applications in the US fell by 1.2% in the week ended 04 November 2016, following a similar decline in the prior week. Meanwhile, the nation’s final wholesale inventories rose less-than-expected by 0.1% in September, compared to a revised drop of 0.1% in the prior month.

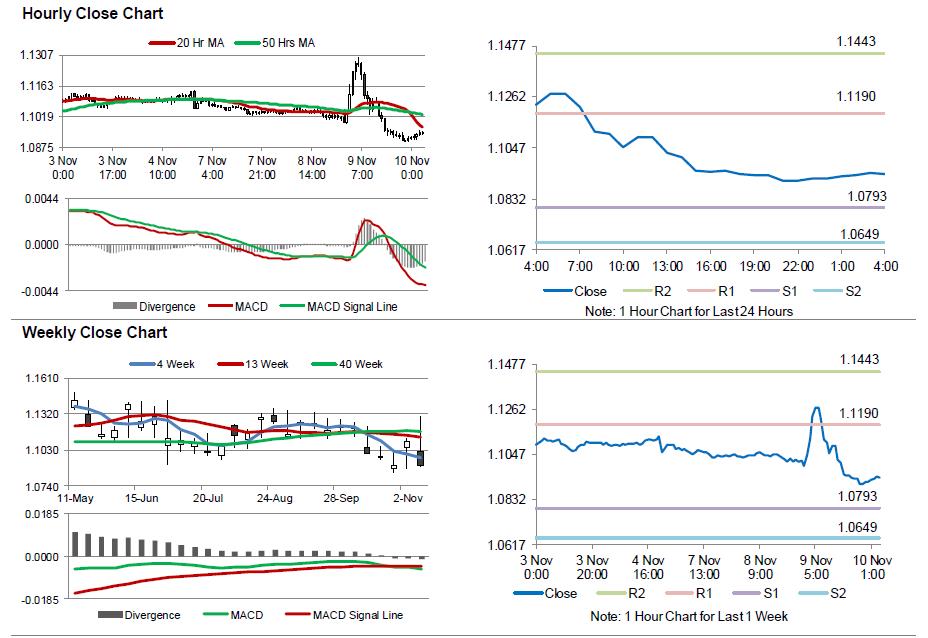

In the Asian session, at GMT0400, the pair is trading at 1.0937, with the EUR trading 0.17% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.0793, and a fall through could take it to the next support level of 1.0649. The pair is expected to find its first resistance at 1.1190, and a rise through could take it to the next resistance level of 1.1443.

Amid a lack of major economic releases in the Euro-zone today, investors would focus on US initial jobless claims and monthly budget statement for October, due to release later today.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.