For the 24 hours to 23:00 GMT, the EUR declined 0.07% against the USD and closed at 1.1192, after the European Commission downgraded its growth forecasts for the euro area.

The European Union (EU), in its latest report, slashed Euro-zone’s 2019 growth forecast to 1.2% from 1.9% predicted earlier, amid uncertainty over trade conflicts and Brexit worries. Further, the estimate for 2020 was lowered to 1.5% from 1.6%. Additionally, the EU cut Germany’s growth outlook for this year to 0.5% from 1.8%, citing weakness in the auto industry. However, the Commission stated that inflation is likely to stay at this year’s levels and below the European Central Bank’s target.

In economic news, Germany’s seasonally adjusted factory orders rose less-than-anticipated by 0.6% on a monthly basis in March, compared to a revised fall of 4.0% in the prior month. Market participants had envisaged factory orders to record a gain of 1.5%. Meanwhile, the nation’s construction PMI dropped to a level of 53.0 in April, amid sluggish growth in commercial, housing and civil engineering operations and following a reading of 55.6 in the prior month.

In the US, data showed that consumer credit rose by $10.3 billion in March, rising at its slowest pace in 9-months and undershooting market expectations for an advance of $16.0 billion. In the prior month, consumer credit had recorded a revised rise of $15.5 billion. Moreover, the US JOLTs job openings jumped more than expected to a level of 7488.0K in March, compared to a revised level of 7142.0K in the prior month. Markets were anticipating the JOLTs job openings to register a gain of 7350.0K.

In the Asian session, at GMT0300, the pair is trading at 1.1200, with the EUR trading 0.07% higher against the USD from yesterday’s close.

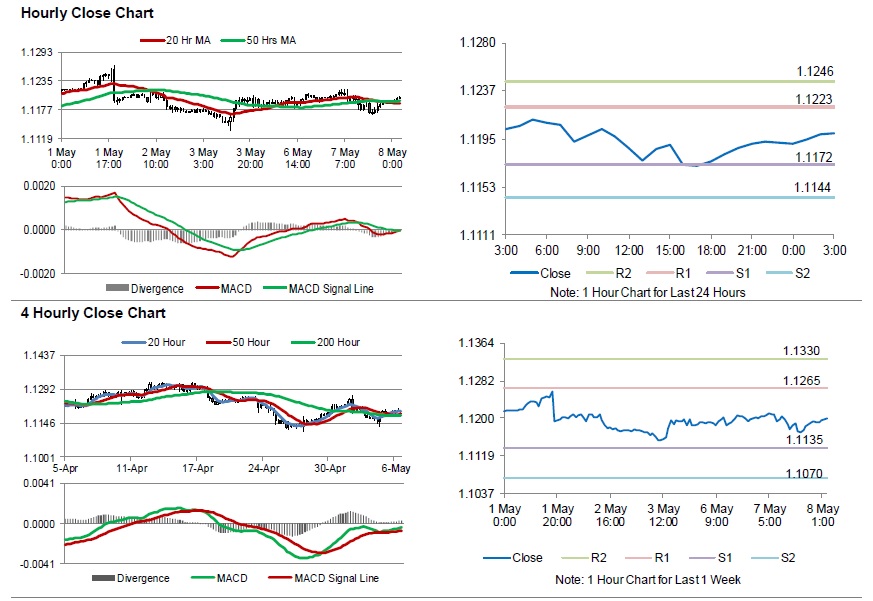

The pair is expected to find support at 1.1172, and a fall through could take it to the next support level of 1.1144. The pair is expected to find its first resistance at 1.1223, and a rise through could take it to the next resistance level of 1.1246.

Moving ahead, traders would closely monitor Germany’s industrial production for March, slated to release in a few hours followed by the ECB President, Mario Draghi’s speech, for further direction. Later in the day, the US MBA mortgage applications, will keep traders on their toes.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.