For the 24 hours to 23:00 GMT, the EUR rose 0.45% against the USD and closed at 1.1343, after Eurozone’s final consumer price index rose more-than-expected by 0.2% YoY in July, notching its highest level in eight months, compared to market expectations for an advance of 0.1% and compared to a rise of 0.2% in the preliminary print. Meanwhile, on a monthly basis, the consumer price index dropped more-than-anticipated by 0.6% MoM in July, compared to a rise of 0.2% in the prior month while markets anticipated the index to drop 0.5%. Additionally, the region’s seasonally adjusted construction output remained flat for the second consecutive month on a monthly basis in June.

Separately, the minutes of the ECB’s latest monetary policy meeting indicated that the policymakers warned that Britain’s decision to leave the European Union (EU) created fresh headwinds and economic uncertainty for the region and could affect the global economic growth. Further, it showed that board members unanimously agreed to adopt a wait-and-watch policy to assess the impact of the historic Brexit vote on the Euro-zone, before launching fresh stimulus to shore up the bloc’s economy.

Macroeconomic data released in the US revealed that, the number of Americans filing for fresh unemployment benefits fell more-than-expected to 262.0K last week, strengthening views that the nation’s labour market continues to be on a stronger footing, that could encourage the US Fed to raise interest rates soon. Initial jobless claims had registered a reading of 266.0K in the prior week whereas markets expected it fall to a level of 265.0K. Also, the nation’s Philadelphia Fed manufacturing index rebounded to a level of 2.0 in August, in line with market expectations and compared to a level of -2.9 in the previous month. Further, the nation’s leading indicator rose 0.4% on a monthly basis in July, higher than market expectations for an advance of 0.3% and after recording a rise of 0.3% in the prior month.

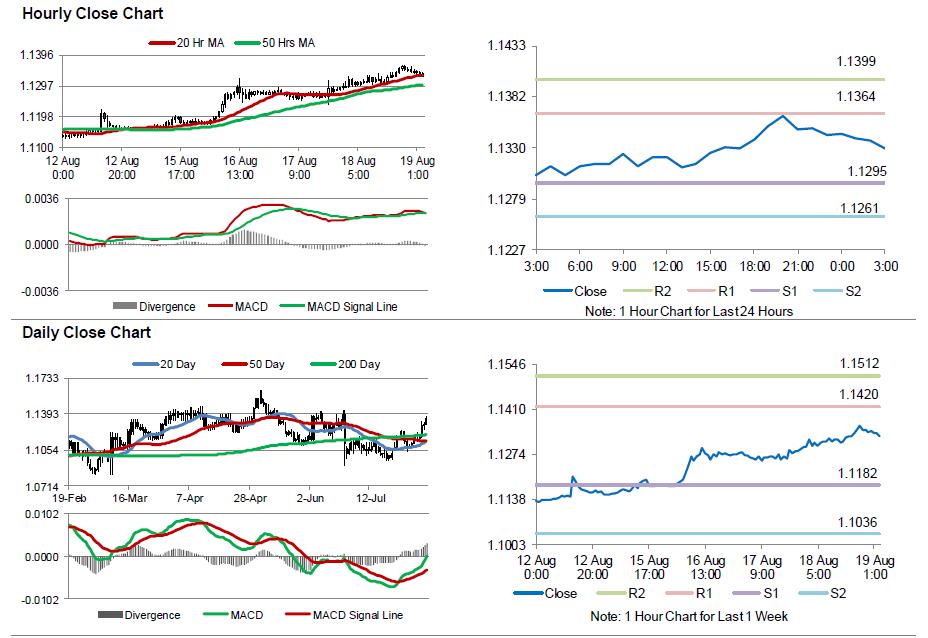

In the Asian session, at GMT0300, the pair is trading at 1.1329, with the EUR trading 0.12% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.1295, and a fall through could take it to the next support level of 1.1261. The pair is expected to find its first resistance at 1.1364, and a rise through could take it to the next resistance level of 1.1399.

Amid no major economic releases in the Euro-zone today, market participants would look forward to the release of preliminary Markit manufacturing and services PMI data for August across the Euro-zone, slated to release next week.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.