For the 24 hours to 23:00 GMT, the EUR rose 0.20% against the USD and closed at 1.1783, after data showed that the Eurozone’s consumer price index (CPI) rose at an annual rate of 1.5% in November, in line with the previous estimate. The increase in the region’s inflation was mainly driven by higher energy prices.

Meanwhile, the US NAHB housing market index climbed to an 18-year high in December, as it rose to 74 from a revised level of 69 in November. Market had expected the index to report a level of 70.

In the Asian session, at GMT0400, the pair is trading at 1.1788, with the EUR trading a tad higher from yesterday’s close.

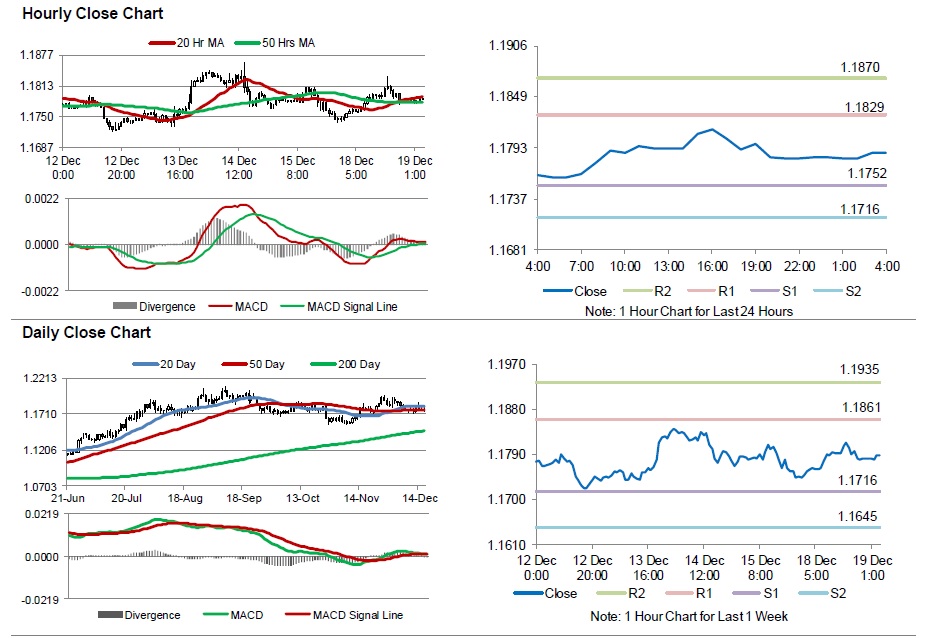

The pair is expected to find support at 1.1752, and a fall through could take it to the next support level of 1.1716. The pair is expected to find its first resistance at 1.1829, and a rise through could take it to the next resistance level of 1.1870.

Moving ahead, Germany’s Ifo survey on business climate, expectations and current assessment, all for December, due in a few hours would be closely monitored by investors. Also, the Eurozone’s construction output data for October would be eyed by market participants. Moreover, the US housing starts and building permits, both for November, scheduled later today, would garner significant amount of market attention.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.