For the 24 hours to 23:00 GMT, the EUR rose 0.9% against the USD and closed at 1.1175, after preliminary consumer price index in the Euro-zone rose more-than-expected to an eight-month high level of 0.2% YoY in July, lifted mostly by higher prices of food, alcohol and tobacco products. Markets expected it to remain steady at prior month’s reading of 0.1%. Additionally, preliminary gross domestic product (GDP) data indicated that Euro-zone’s economy expanded by 0.3% on a quarterly basis in 2Q 2016, meeting market expectations and following an advance of 0.6% in the prior quarter. Also, the region’s unemployment rate remained steady at 10.1% in June, in line with market consensus.

The US Dollar lost ground, after disappointing growth data in the US diminished the possibility of a Fed rate hike as soon as in September.

The preliminary annualised GDP data indicated that the US economy grew less-than-expected by 1.2% on a quarterly basis in 2Q 2016, compared to a rise of 1.1% in the previous quarter whereas markets anticipated the economy to grow by 2.5%. Moreover, the nation’s final Michigan consumer sentiment index dropped to a level of 90.0 in July, compared to market expectations for a rise to a level of 90.2 and after recording a preliminary reading of 89.5. Additionally, the Chicago purchasing managers’ index slipped to 55.8 in July, from last month’s 56.8, surpassing consensus forecast of 54.0.

In the Asian session, at GMT0300, the pair is trading at 1.1171, with the EUR trading marginally lower against the USD from Friday’s close.

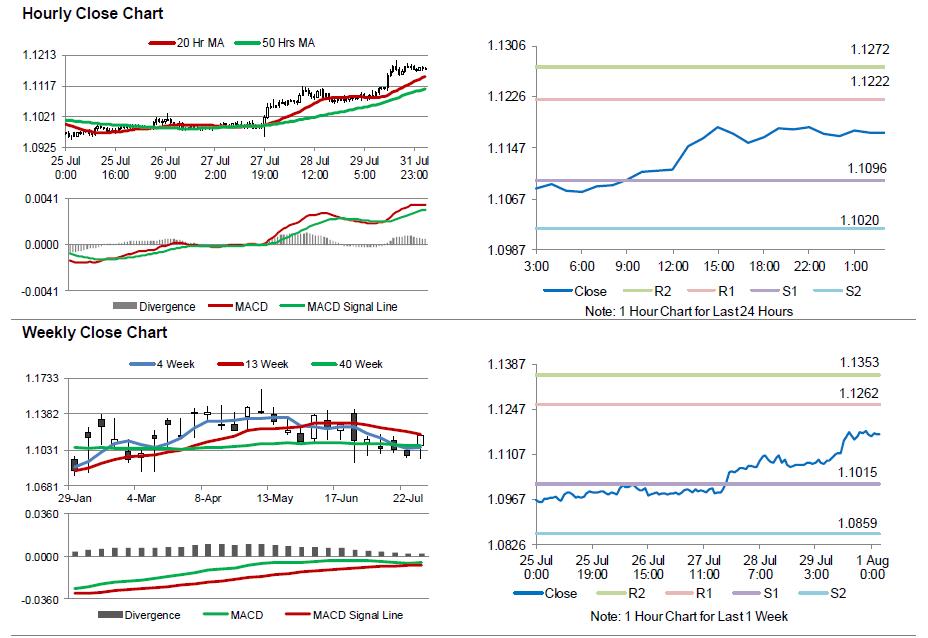

The pair is expected to find support at 1.1096, and a fall through could take it to the next support level of 1.1020. The pair is expected to find its first resistance at 1.1222, and a rise through could take it to the next resistance level of 1.1272.

Moving ahead, investors will look forward to the final Markit manufacturing PMI data for July across the Euro-zone, slated to release in a few hours. Additionally, in the US, the upcoming ISM survey data for July, scheduled to release later in the day, will also garner a lot of market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.