For the 24 hours to 23:00 GMT, the EUR declined marginally against the USD and closed at 1.1167, after data indicated that activity in the manufacturing sector expanded at a moderate pace across the Euro-zone.

Data revealed that, Euro-zone’s final Markit manufacturing PMI eased to a level of 52.0 in July, higher than market expectations of a drop to a level of 51.9 and following a reading of 52.8 in the prior month. Additionally, in Germany, the final Markit manufacturing PMI declined to a level of 53.8 in July, compared to market expectations of a fall to a level of 53.7 and after recording a reading of 54.5 in the previous month. French factory activity contracted for the fifth straight month in July, Spanish manufacturing PMI fell to the lowest since 2013.

Macroeconomic data released in the US indicated that, the ISM manufacturing activity expanded at a slower-than-expected pace, after the index dropped to a level of 52.6 in July, as concerns of possible consequences of Brexit weighed on nation’s manufacturers. Markets expected the index to drop to a level of 53.0, compared to a reading of 53.2 in the prior month. On the other hand, the nation’s construction spending fell for a third straight month, after it unexpectedly dropped by 0.6% MoM in June, hitting its lowest level since June 2015 and defying investor sentiment for it to climb by 0.5%. In the prior month, construction spending recorded a revised fall of 0.1%. Further, the nation’s final Markit manufacturing PMI advanced to a level of 52.9 in July, meeting market expectations and following a reading of 51.3 in the previous month.

Meanwhile, the New York Fed President, William Dudley, stated that the US Fed should adopt a cautious approach on interest rate hikes, citing global risks to the US economy. However, he also added that, it would be premature to rule out an interest rate hike in this year.

In the Asian session, at GMT0300, the pair is trading at 1.1169, with the EUR trading marginally higher against the USD from yesterday’s close.

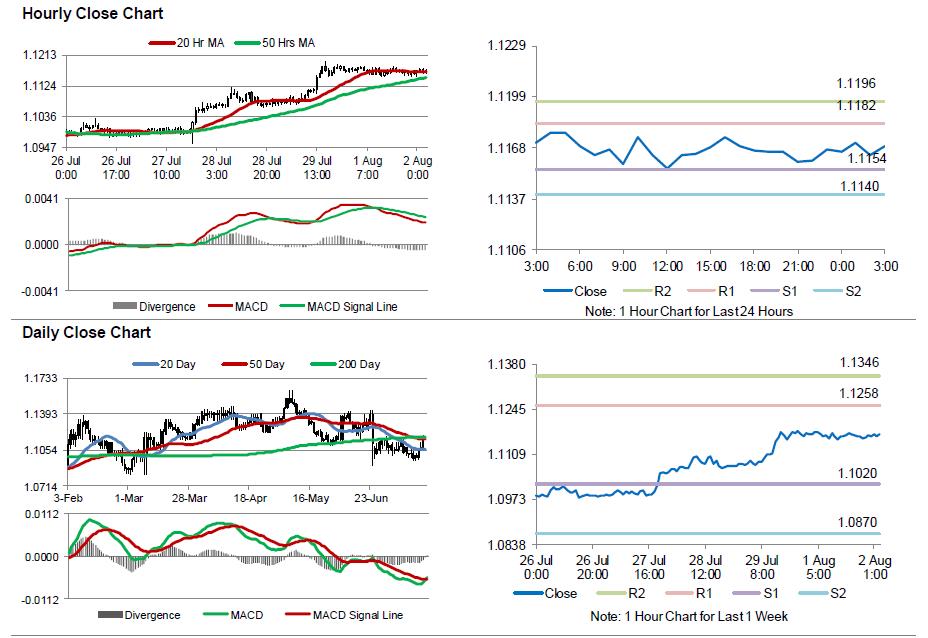

The pair is expected to find support at 1.1154, and a fall through could take it to the next support level of 1.114. The pair is expected to find its first resistance at 1.1182, and a rise through could take it to the next resistance level of 1.1196.

Going ahead, investors would look forward to the US personal spending and consumption data for June, slated to release later in the day.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.