For the 24 hours to 23:00 GMT, the EUR rose 0.3% against the USD and closed at 1.1193.

In economic news, the Euro-zone’s final Markit manufacturing PMI was revised down to a three-month low level of 51.7 in August, suggesting that the manufacturing sector in the common currency region continued to struggle. Meanwhile, markets expected it to remain steady at a preliminary reading of 51.8. Additionally, Germany’s final Markit manufacturing PMI came in at a level of 53.6 in August, meeting market expectations and confirming the preliminary print.

The greenback lost ground against its key counterparts, after data indicated that the US ISM manufacturing index unexpectedly dropped to a level of 49.4 in August, contracting for the first time in six months, thus casting fresh doubts on the strength of the world’s biggest economy. The ISM manufacturing index recorded a reading of 52.6 in the previous month, whereas markets anticipated it to drop to a level of 52.0. Moreover, the final Markit manufacturing PMI fell to a level of 52.0 in August, revised down from its preliminary print of 52.1. Further, the nation’s construction spending surprisingly remained flat on a monthly basis in July, defying market expectations for an advance of 0.5% and compared to a revised gain of 0.9% in the previous month. On the other hand, the nation’s initial jobless claims rose less-than-anticipated to a level of 263.0K during the week ended 27 August 2016 and after registering a level of 261.0K in the previous week.

In the Asian session, at GMT0300, the pair is trading at 1.1197, with the EUR trading marginally higher against the USD from yesterday’s close.

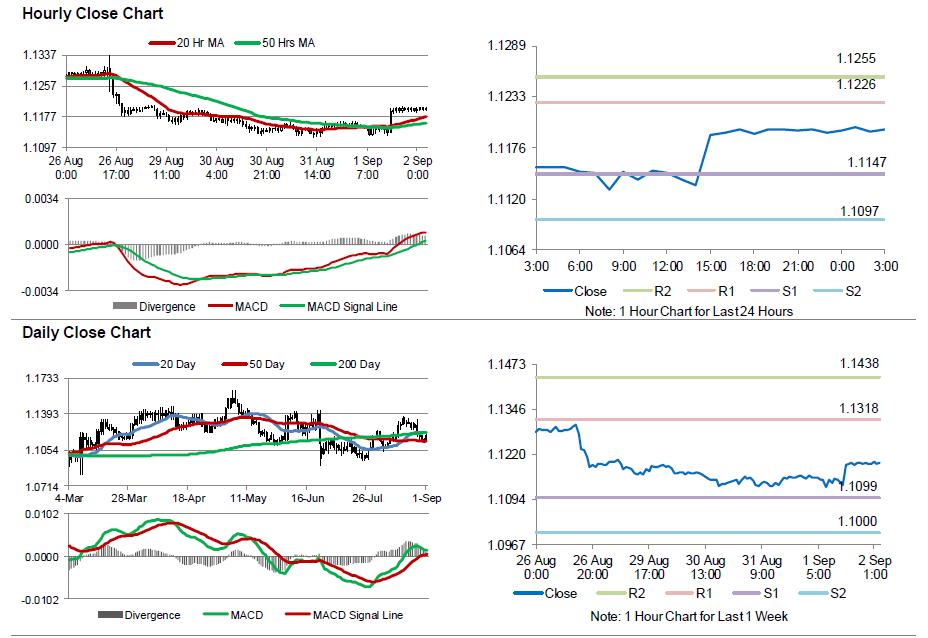

The pair is expected to find support at 1.1147, and a fall through could take it to the next support level of 1.1097. The pair is expected to find its first resistance at 1.1226, and a rise through could take it to the next resistance level of 1.1255.

Moving ahead, market participants would await the release of the much anticipated US non-farm payrolls and unemployment rate data along with the nation’s trade balance and factory orders data, all due later in the day.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.