For the 24 hours to 23:00 GMT, the EUR declined 0.49% against the USD and closed at 1.0970, after flash services PMI in the Eurozone eased more-than-expected to a level of 52.7 in July, hitting its lowest level since January 2015. The index had registered a reading of 52.8 in the preceding month while markets expected it to drop to a level of 52.3. Additionally, the region’s preliminary manufacturing PMI dropped to a level of 51.9 in July, higher than market expectations of a fall to a level of 52.0 and compared to a level of 52.8 in the previous month. Meanwhile, data released in Germany indicated that activity in the service sector unexpectedly advanced to a two-month high level of 54.6 in July, beating market consensus of a fall to a level of 53.2 and after recording a level of 53.7 in the preceding month. In addition, the nation’s manufacturing PMI fell to a two-month low level of 53.7 in July. Market anticipation was for manufacturing PMI to decline to a level of 53.4, compared to a level of 54.5 in the prior month. Elsewhere, in France, the flash services PMI rose more-than-expected to 50.3 in July from 49.9 in June and the manufacturing PMI improved to a four-month high of 48.6 from 48.3 in June, although it still remained in the contraction territory.

The US dollar gained ground, after data suggested that the preliminary Markit manufacturing PMI advanced more-than-forecasted to a nine-month high level of 52.9 in July, thus indicating that the manufacturing sector is proving to be a bright spot in the nation’s economy. The index had registered a reading of 51.3 in the prior month whereas markets expected it to rise to a level of 51.5.

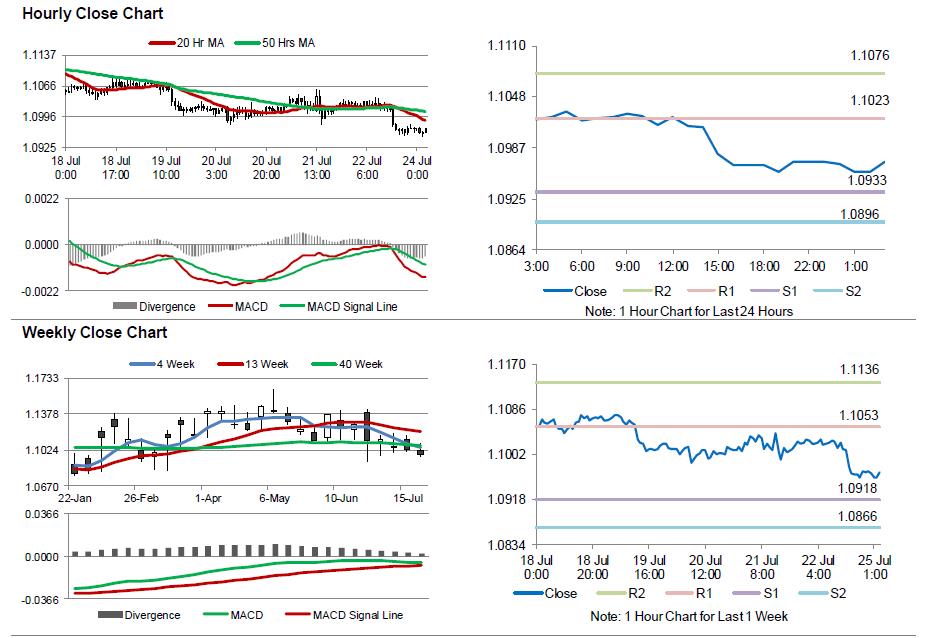

In the Asian session, at GMT0300, the pair is trading at 1.0969, with the EUR trading marginally lower against the USD from Friday’s close.

The pair is expected to find support at 1.0933, and a fall through could take it to the next support level of 1.0896. The pair is expected to find its first resistance at 1.1023, and a rise through could take it to the next resistance level of 1.1076.

Going ahead, market participants will shift their focus to Germany’s IFO expectations and business climate data, due to release in a few hours. Additionally, the US Dallas Fed manufacturing business index data, scheduled to release later today, will also attract a lot of market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.