For the 24 hours to 23:00 GMT, the EUR declined 0.18% against the USD and closed at 1.1688.

Macroeconomic data showed that, Eurozone’s seasonally adjusted gross domestic product (GDP) grew at a slower than expected pace of 0.3% on a quarterly annual basis in Q2 2018, marking its weakest expansion in two years and undershooting market consensus for a gain of 0.4%. In the preceding month, the GDP had recorded a rise of 0.4%. Meanwhile, the region’s preliminary consumer price index advanced 2.1% on an annual basis in July, hitting its highest level since December 2012 and compared to an advance of 2.0% in the prior month. Markets had anticipated the index to record an unchanged reading. Other data showed that unemployment rate remained steady at 8.3% in June, at par with market expectations and marking its lowest level since December 2008.

Separately, in Germany, retail sales rebounded 3.0% on an annual basis in June, higher than market expectations for an advance of 1.5%. Retail sales had registered a drop of 1.6% in the previous month. Furthermore, the nation’s seasonally adjusted unemployment rate remained steady at 5.2% in July, in line with market expectations.

In the US, data showed that the US consumer confidence index unexpectedly climbed to a level of 127.4 in July, defying market expectations for a drop to a level of 126.00. The index had registered a revised reading of 127.1 in the prior month. Also, the nation’s Chicago Fed purchasing managers index surprisingly surged to a level of 65.5 in July, compared to market anticipation for a decline to a level of 62.0. The index had recorded a reading of 64.1 in the previous month.

Moreover, US personal income edged 0.4% on a monthly basis in June, meeting market expectations and following a similar rise in the previous month. Personal spending advanced 0.4%, at par with market expectations and after recording a revised rise of 0.5% in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.1687, with the EUR trading marginally lower against the USD from yesterday’s close.

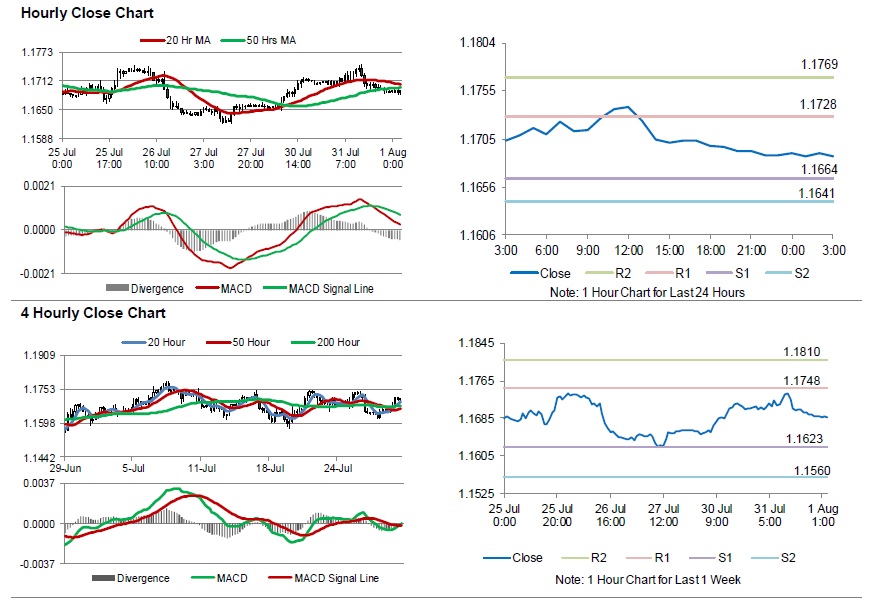

The pair is expected to find support at 1.1664, and a fall through could take it to the next support level of 1.1641. The pair is expected to find its first resistance at 1.1728, and a rise through could take it to the next resistance level of 1.1769.

Moving forward, traders would closely monitor the Markit manufacturing PMI for July, scheduled to be release across the euro bloc in a few hours. Later in the day, investors would focus on the US Federal Reserve rate decision. Additionally, the US Markit manufacturing PMI and ADP employment change, both for July, along with construction spending data for June, will garner significant amount of investor attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.