For the 24 hours to 23:00 GMT, the EUR declined 0.64% against the USD and closed at 1.1146.

Markit services PMI data indicated that activity in Euro-zone’s service sector unexpectedly expanded to a level of 52.9 in July, expanding for thirty-seventh straight month. Markets expected the index to fall to a level of 52.7, following a level of 52.8 in the previous month. Also, the region’s retail sales remained flat on a monthly basis in June, in line with market expectations and following a gain of 0.4% in the previous month. On the other hand, in Germany, the final Markit services PMI climbed to a level of 54.4 in July, compared to market expectations of an advance to a level of 54.6 and after recording a reading of 53.7 in the prior month.

The final Markit data for July revealed that the French and Italian service sector picked up more strongly than initially thought, while Spain services PMI slipped, despite upbeat industrial conditions.

The US Dollar gained ground after, data indicated that the US ADP employment rose by 179.0K in July, indicating that the nation’s labour market was holding up. The private sector employment had registered a revised increase of 176.0K in the previous month while markets anticipated for an advance of 170.0K. Also, the nation’s final Markit services PMI remained unchanged at a level of 51.4 in July, compared to market expectations of a drop to a level of 51.0. On the other hand, the nation’s ISM non-manufacturing PMI eased more-than-expected to a level of 55.5 in July, compared to a level of 56.5 in the prior month while markets expected the index to drop to a level of 55.9.

In the Asian session, at GMT0300, the pair is trading at 1.1147, with the EUR trading marginally higher against the USD from yesterday’s close.

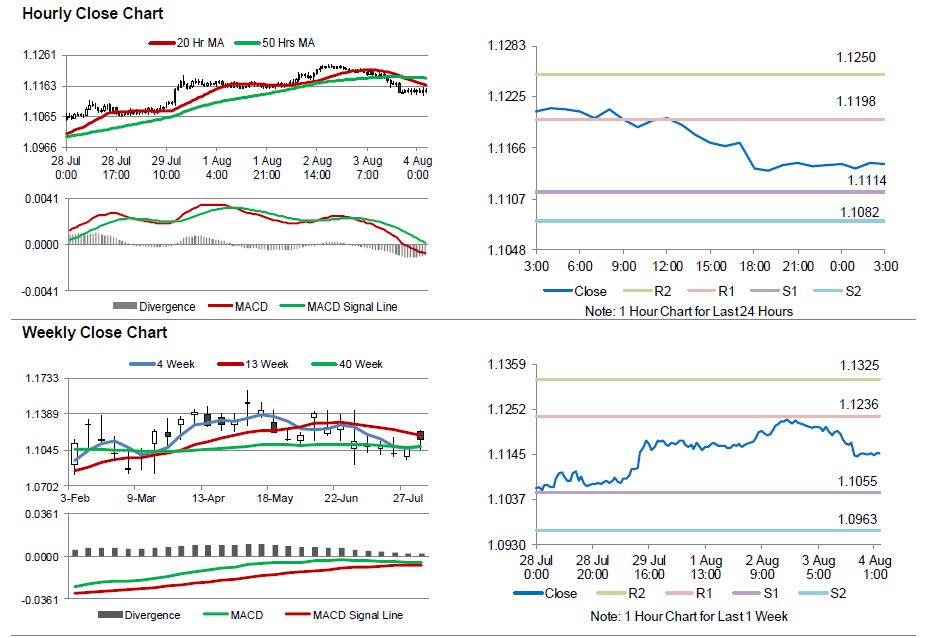

The pair is expected to find support at 1.1114, and a fall through could take it to the next support level of 1.1082. The pair is expected to find its first resistance at 1.1198, and a rise through could take it to the next resistance level of 1.1250.

Moving ahead, investors await the release of Euro-zone’s economic bulletin report, scheduled in a few hours. Additionally, the US initial jobless claims, durable goods orders and factory orders data, slated to release later today, will also garner a lot of market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.