For the 24 hours to 23:00 GMT, EUR declined 0.06% against the USD and closed at 1.3637.

The US Dollar advanced against the single currency after Janet Yellen, in her first testimony before the Congress as the Fed’s Chief, indicated a continuation in the tapering of the Fed’s asset-purchase programme unless the economic outlook worsened significantly. Additionally, she opined that “the recovery in the labour market is far from complete”. However, at the same time, she cautioned market participants against “jumping to conclusions” and further assured that the central bank would likely take “further measured steps” to curb its stimulus, only if data broadly supported policymakers’ expectation of improved labour markets and a rise in inflation. Separately, Philadelphia Fed President, Charles Plosser, reiterated his earlier views that the Federal Reserve should move faster in winding down its bond purchasing programme, as the central bank’s quantitative easing measure is “neither helpful nor essential.”

Yesterday, the lower house of the United States Congress approved a measure to raise the country’s debt ceiling for one more year. However it is yet to win the approval of the Senate, which could act on it as early as this week.

Meanwhile, in the Euro-zone, the ECB Governing Council member, Erkki Liikanen, hinted at negative interest rates in case the inflation outlook in the region deteriorates. However, he dismissed deflation fears in the Euro-zone economy. Separately, German Finance Minister, Wolfgang Schaeuble also stressed that there were no deflation risks in the region but warned that the export sector of the Euro-bloc could get roiled by the recent turmoil in the emerging markets.

In the Asian session, at GMT0400, the pair is trading at 1.3628, with the EUR trading 0.07% lower from yesterday’s close.

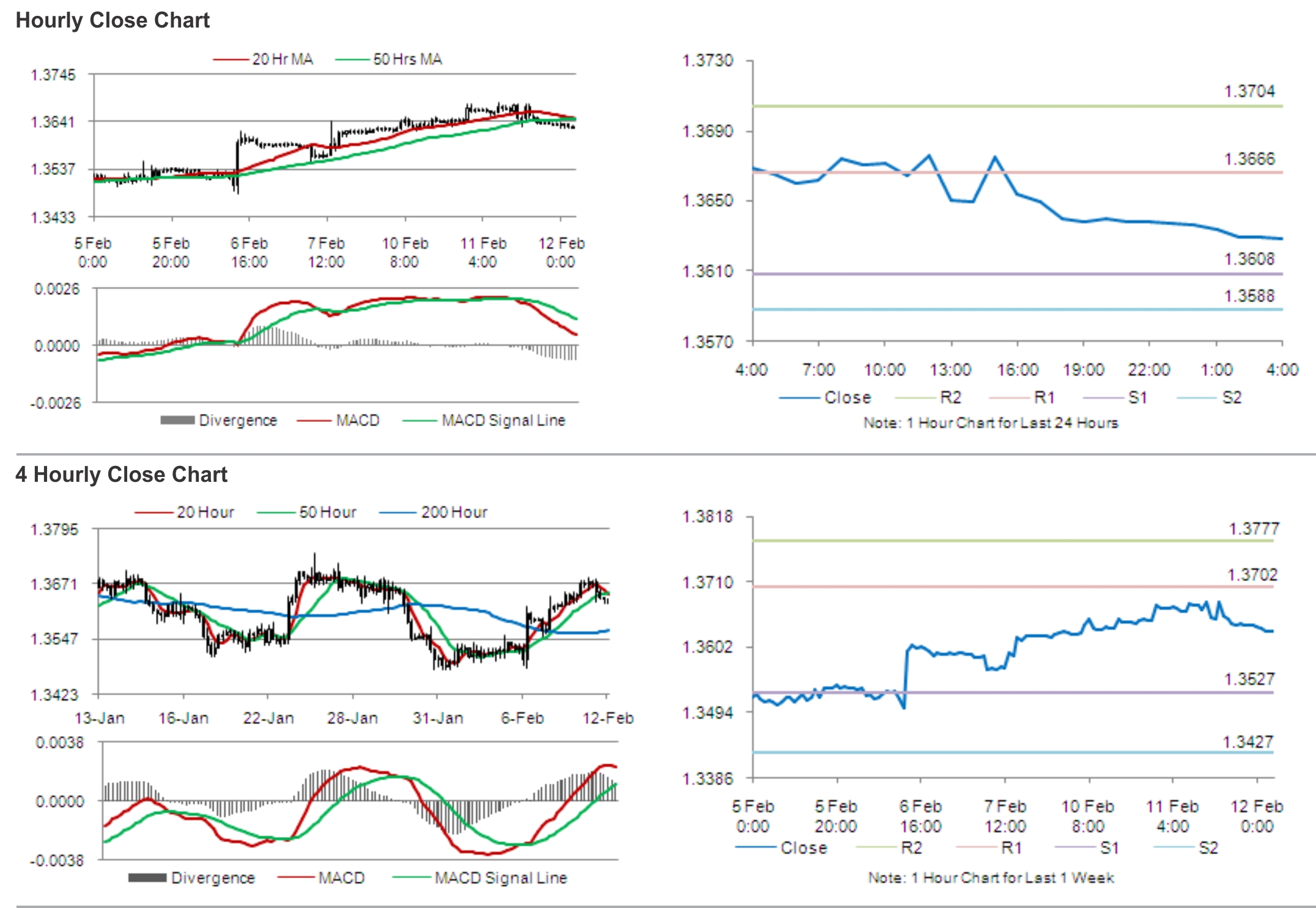

The pair is expected to find support at 1.3608, and a fall through could take it to the next support level of 1.3588. The pair is expected to find its first resistance at 1.3666, and a rise through could take it to the next resistance level of 1.3704.

Traders await the Euro-zone’s industrial production data and the ECB President, Mario Draghi’s speech for further cues in the Euro.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.