For the 24 hours to 23:00 GMT, EUR rose 0.26% against the USD and closed at 1.3523, after a report showed that the Euro-zone’s Markit manufacturing PMI advanced to a reading of 54.0 in January, more than analysts’ call for a rise to a reading of 53.9, from previous month’s level of 52.7. Separately, another report revealed that Markit manufacturing PMI for the German economy also registered an upbeat rise of 56.5 in January, the highest level in 32-months and compared to a level of 54.3 recorded in the preceding month.

Meanwhile, the US Dollar gave up some ground against the single currency after data showed that the ISM manufacturing PMI in the US fell to a reading of 51.3 in January, the lowest figure since May, from previous month’s revised figure of 56.5. Similarly, the Markit manufacturing PMI in the US eased down to a three-month low reading of 53.7 in January, from a final level of 55.0 reported in the previous month. The construction spending in the US increased 0.1% on a monthly basis in December, as compared to a revised gain of 0.8% recorded in the previous month.

Separately, the US Treasury Secretary, Jacob Lew warned of the possibility of a US government default, should the borrowing limit of the government be extended on an urgent basis. However the losses in the greenback were kept in check after Dallas Fed President, Richard Fisher, in an interview, suggested the central bank to continue with tapering its bond purchases, despite a fall in the US equity markets and currency turmoil in the overseas economies. He further hinted that the Fed is focused on the performance of the “real” economy and not just the stock market.

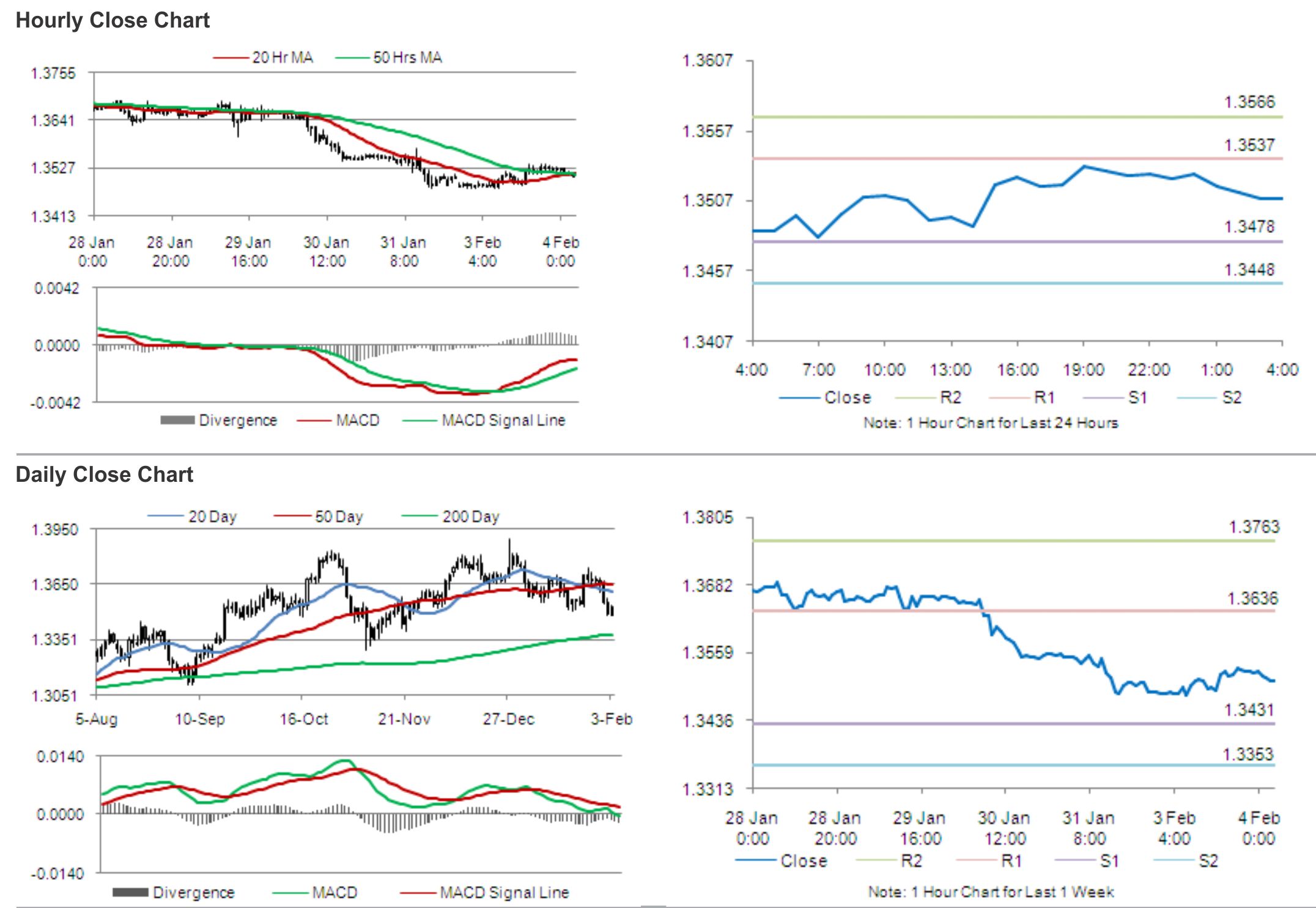

In the Asian session, at GMT0400, the pair is trading at 1.3508, with the EUR trading 0.11% lower from yesterday’s close.

The pair is expected to find support at 1.3478, and a fall through could take it to the next support level of 1.3448. The pair is expected to find its first resistance at 1.3537, and a rise through could take it to the next resistance level of 1.3566.

Later today, the Eurostat is expected to release a report on the Euro-zone’s producer price index.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.