For the 24 hours to 23:00 GMT, the EUR declined 0.46% against the USD and closed at 1.0913.

On the macro front, Euro-zone’s preliminary manufacturing PMI climbed to 51.90 in March, compared to a level of 51.00 in the prior month. Market anticipations were for the manufacturing PMI to climb to 51.50. Meanwhile, the region’s preliminary services PMI advanced to 54.30 in March, higher than market expectations of an advance to 53.90. In the previous month, services PMI had recorded a level of 53.70.

Additionally, Germany’s preliminary manufacturing PMI in March advanced to 52.40, higher than market expectations of an advance to a level of 51.50. Manufacturing PMI had recorded a reading of 51.10 in the prior month. Similarly, the nation’s preliminary services PMI too registered a rise to 55.30 in the same month, higher than market expectations of an advance to a level of 55.00. Services PMI had registered a level of 54.70 in the previous month.

The US Dollar was boosted after the consumer price index in the US recorded a rise of 0.20% in February on a MoM basis, compared to a drop of 0.70% in the previous month. Furthermore, new home sales in the US unexpectedly advanced by 7.80%, on monthly basis, to a level of 539.00 K in February, compared to a revised level of 500.00 K in the previous month. Markets were expecting new home sales to fall to 465.00 K. The flash Markit manufacturing PMI in March registered an unexpected rise to a level of 55.30 in the US, compared to market expectations of a drop to a level of 54.60. In the previous month, the Markit manufacturing PMI had registered a reading of 55.10.

Yesterday, US Fed policymaker, James Bullard, stated that the central bank should start increasing interest rates at the earliest, as an accommodative policy stance was no longer suitable, amid falling unemployment and a robust pace of growth in the nation’s economy.

In the Asian session, at GMT0300, the pair is trading at 1.0937, with the EUR trading 0.22% higher from yesterday’s close.

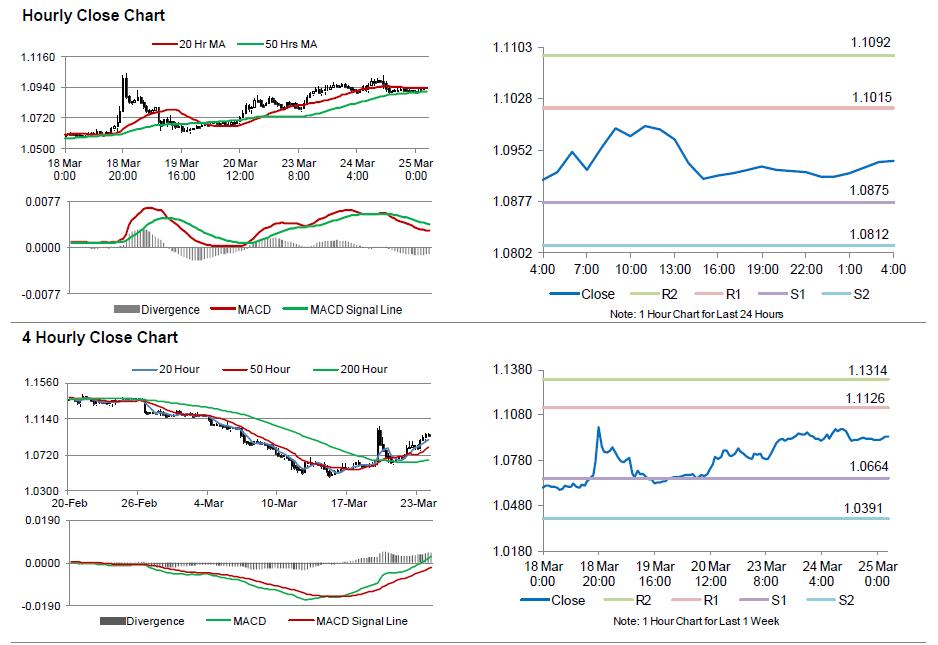

The pair is expected to find support at 1.0875, and a fall through could take it to the next support level of 1.0812. The pair is expected to find its first resistance at 1.1015, and a rise through could take it to the next resistance level of 1.1092.

Trading trends in the pair today are expected to be determined by the crucial durable goods orders data for February from the US slated to release later during the day.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.