On Friday, the EUR declined 0.17% against the USD and closed at 1.3639, as the latter benefitted from the latest batch of strong economic releases from the US economy. Data from the US showed that jobless rate in the world largest economy unexpectedly stood pat at an almost six-year low level of 6.3% while non-farm payrolls increased by 217,000 numbers in May, marking its fourth consecutive month of increase by more than 200,000. Separately, the Fed reported that total consumer credit rose more-than-expected by $26.85 billion to $3.18 trillion in April, as demand for credit-card rose the most since November 2007. Meanwhile, the Fed Governor, Jerome Powell, at a conference in London, opined that the central bank’s forward rate guidance has provided meaningful support for the economy. Furthermore, he hinted that interest rates in the US would rise only when he would see some signs of tightening in the economy, as, according to him, there still remained a “significant” amount of slackness in the US economy.

In the Euro-zone, ECB Vice-President, Vitor Constancio stated that the central bank would probably not know until the end of the year whether its recent stimulus measures have been effective while hinting that the ECB is mulling an asset purchase programme in Euro-zone should the economy hit a major stumbling block. In other economic news, German month-on-month industrial production rebounded 0.2% in April as trade surplus in the Euro-zone’s largest economy widened in April. Separately, trade deficit of France unexpectedly narrowed to €3.9 billion in April, due to a notable decline in imports.

In a noteworthy event, the S&P rating agency, citing strong economic growth in the US economy, affirmed the nation’s “AA+” credit rating with a “Stable” outlook. Separately, the New York-based agency also upgraded Ireland’s credit rating to “A-” from “BBB+” and raised its 2014-2016 average GDP growth rate to 2.7% from 2.0%.

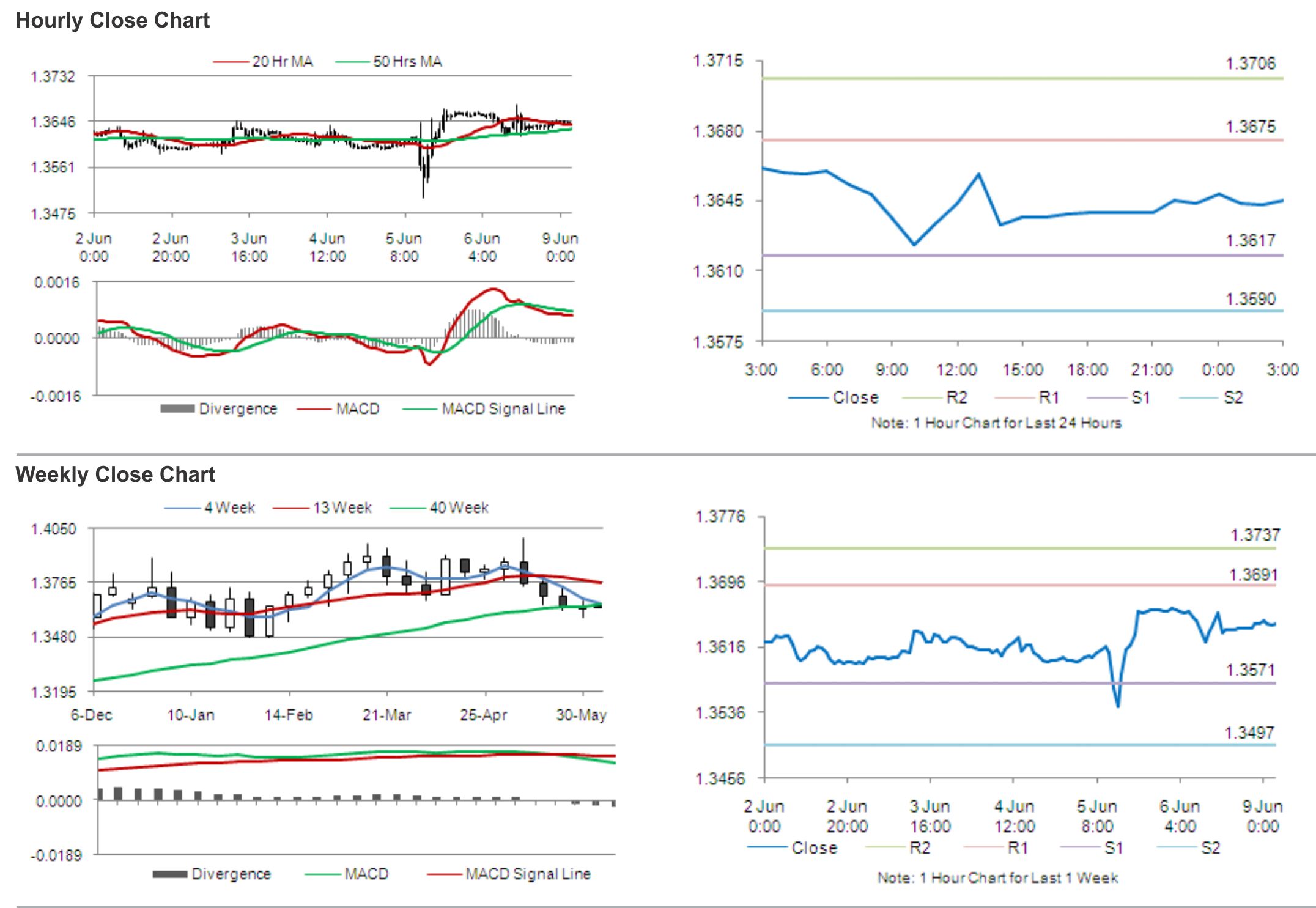

In the Asian session, at GMT0300, the pair is trading at 1.3645, with the EUR trading slightly higher from Friday’s close.

Early morning, reports indicated that the Dallas Fed President, Richard Fisher, would propose to end the Fed’s quantitative easing in October, by urging the central bank to trim its final $5 billion of asset purchases before the December meeting.

The pair is expected to find support at 1.3617, and a fall through could take it to the next support level of 1.3590. The pair is expected to find its first resistance at 1.3675, and a rise through could take it to the next resistance level of 1.3706.

Market participants are expected to keep a tab on Euro-zone’s Sentix investor confidence, which would unveil market option about the current economic situation.

The currency pair is showing convergence with its 20 Hr moving average and is trading just above its 50 Hr moving average.