For the 24 hours to 23:00 GMT, the EUR declined 0.16% against the USD and closed at 1.1397.

In economic news, Germany’s final consumer price index (CPI) rose 1.6% on an annual basis in June, confirming the flash estimate. The CPI had advanced 1.5% in the previous month.

In the US, data showed that the number of Americans filing for fresh jobless claims eased to a level of 247.0K in the week ended 08 July, dropping for the first time in a month, suggesting that the nation’s labour market remains buoyant. In the previous week, initial jobless claims had registered a revised reading of 250.0K, while markets were anticipating for a fall to a level of 245.0K. Additionally, the nation’s producer price index (PPI) advanced 2.0% on an annual basis in June, surpassing market consensus for a rise of 1.9%. The PPI had registered a rise of 2.4% in the prior month.

On the other hand, the nation’s budget deficit widened more-than-expected to a level of $90.2 billion in June, compared to market expectations of a deficit of $38.0 billion. In the previous month, the nation had registered a budget deficit of $6.3 billion.

In the Asian session, at GMT0300, the pair is trading at 1.1408, with the EUR trading 0.1% higher against the USD from yesterday’s close.

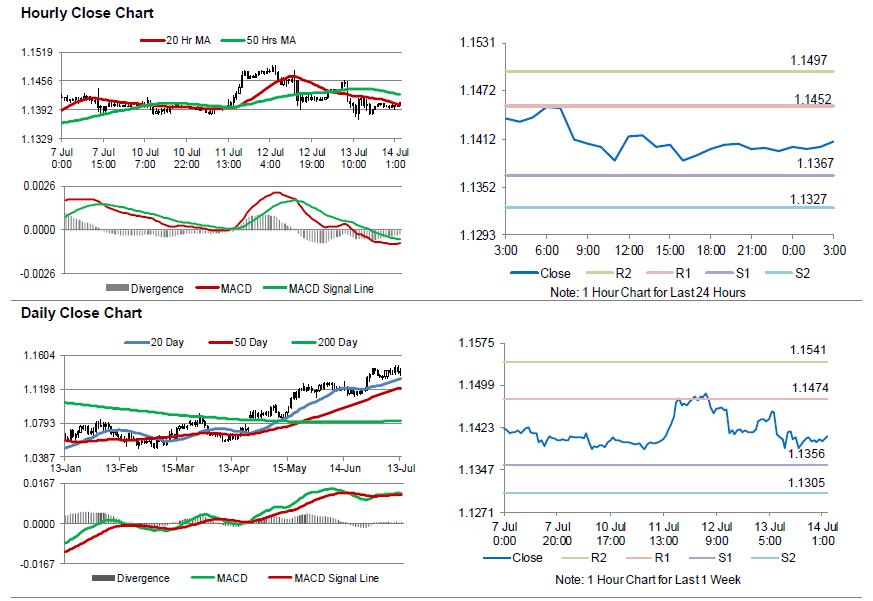

The pair is expected to find support at 1.1367, and a fall through could take it to the next support level of 1.1327. The pair is expected to find its first resistance at 1.1452, and a rise through could take it to the next resistance level of 1.1497.

Going ahead, investors will look forward to the Euro-zone’s trade balance figures for May, slated to release in a few hours. Moreover, traders would closely monitor a slew of crucial economic releases in the US, consisting of the consumer price index, advance retail sales, industrial and manufacturing production, all for June followed by the flash Michigan consumer confidence index for July, all scheduled to release later today.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.