For the 24 hours to 23:00 GMT, the EUR rose 0.23% against the USD and closed at 1.0864, after Germany’s Ifo business climate index surprisingly advanced to a nearly seven-year high level of 112.3 in March, underscoring optimism over the health of the nation’s business sector, despite rumblings of protectionism across the Euro-zone. Markets expected the index to remain steady at a revised level of 111.1, registered in the prior month.

Additionally, the nation’s Ifo business expectations index climbed more-than-expected to a level of 105.7 in March, against market expectations of an advance to a level of 104.3 and after recording a reading of 104.2 in the prior month. Also, the nation’s Ifo current assessment index registered an unexpected rise to a level of 119.3 in March, confounding expectations of a drop to a level of 118.3 and compared to a level of 118.4 in the previous month.

In the US, the Chicago Federal Reserve (Fed) President, Charles Evans, stated that three interest rate hikes remain more plausible this year, but two rate hikes are also conceivable, as the outlook remains uncertain, particularly with the latest failure of the healthcare bill. Nevertheless, he also added that the central bank could raise interest rates four times this year if inflation picks up markedly.

Separately, the Dallas Fed President, Robert Kaplan, indicated that he would support further monetary policy tightening if the US economy continues to show progress and nears the central bank’s dual mandate of full employment and 2.0% inflation.

In the Asian session, at GMT0300, the pair is trading at 1.0859, with the EUR trading slightly lower against the USD from yesterday’s close.

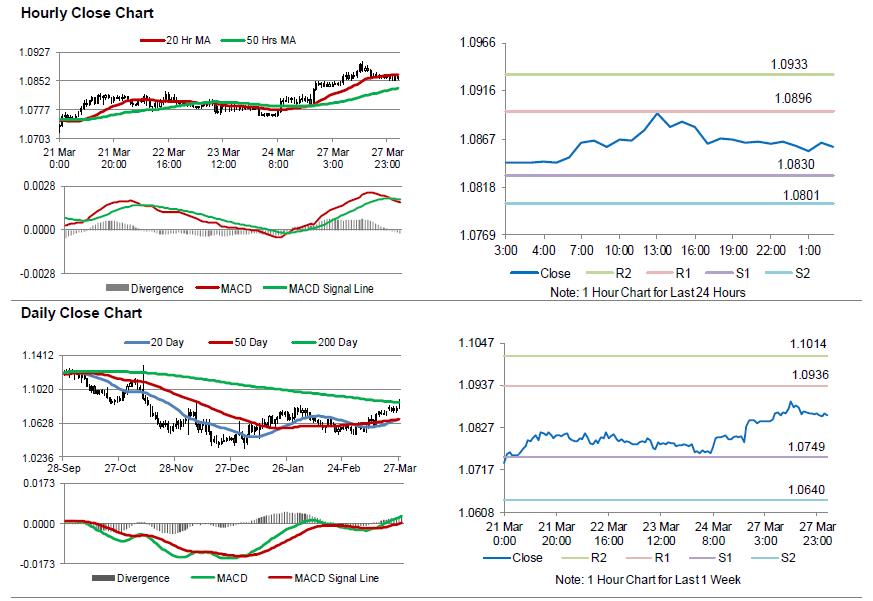

The pair is expected to find support at 1.0830, and a fall through could take it to the next support level of 1.0801. The pair is expected to find its first resistance at 1.0896, and a rise through could take it to the next resistance level of 1.0933.

With no crucial economic releases in the Euro-zone today, investors would direct their attention to a speech by the US Fed Chief, Janet Yellen, scheduled later today. Moreover, the US CB consumer confidence index for March as well as advance goods trade balance and wholesale inventories data, both for February, will garner a significant amount of market attention.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.