For the 24 hours to 23:00 GMT, the EUR rose 0.43% against the USD and closed at 1.1816, after an unexpected rise in German Ifo data suggested that business confidence remains buoyant as the nation’s economic fundaments remain strong.

Germany’s Ifo business climate index unexpectedly advanced to a record high level of 116.7 in October, confounding market expectations for a drop to a level of 115.1 and following a revised reading of 115.3 in the prior month. Further, the nation’s Ifo business expectations index surprised to the upside, climbing to a level of 109.1 in October. Market participants had envisaged for a fall to a level of 107.3, compared to a revised reading of 107.5 in the previous month. Additionally, the nation’s Ifo current assessment index recorded an unexpected rise to a level of 124.8 in October, against market consensus for a drop to a level of 123.5. In the previous month, the index had registered a revised reading of 123.7.

Macroeconomic data indicated that the preliminary durable goods orders in the US jumped to a three-month high in September, after it increased more-than-expected by 2.2%, amid robust demand for transportation equipment, suggesting that business spending remained robust in the third quarter. Markets had anticipations for a rise of 1.0%, following a rise of 2.0% in the previous month. Further, the nation’s new home sales unexpectedly climbed 18.9% on a monthly basis to a level of 667.0K in September, surging to a ten-year high level and providing fresh hints that the housing market was regaining momentum after appearing to stall in recent months. New home sales had registered a revised reading of 561.0K in the previous month, while markets were anticipating for a drop to a level of 554.0K.

Other data revealed that the US mortgage applications dropped 4.6% in the week ended 20 October 2017. In the previous week, mortgage applications had climbed 3.6%.

In the Asian session, at GMT0300, the pair is trading at 1.1825, with the EUR trading 0.08% higher against the USD from yesterday’s close.

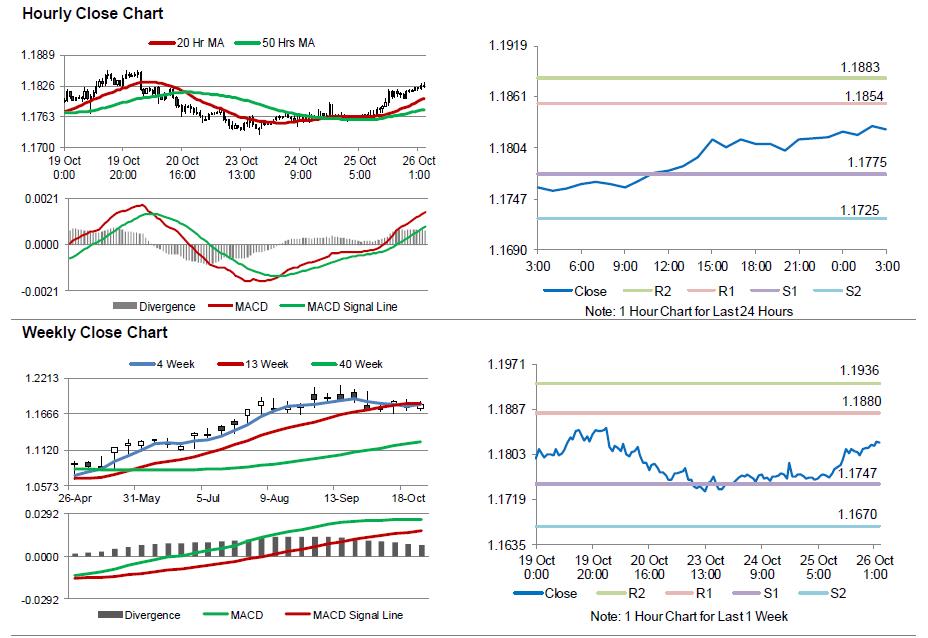

The pair is expected to find support at 1.1775, and a fall through could take it to the next support level of 1.1725. The pair is expected to find its first resistance at 1.1854, and a rise through could take it to the next resistance level of 1.1883.

Moving ahead, all eyes will be on the European Central Bank’s (ECB) interest rate decision, due later in the day, wherein the central bank is expected to shed more light on the tapering of its quantitative easing programme. Moreover, the US initial jobless claims followed by advance goods trade balance and pending home sales data, both for September, all slated to release later in the day, will garner significant amount of market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.