For the 24 hours to 23:00 GMT, the EUR rose 0.3% against the USD and closed at 1.0991.

In economic news, data indicated that Germany’s Ifo business climate index dropped less-than-expected to a level of 108.3 in July, indicating that Euro-zone’s largest economy survived the initial fallout after Brexit vote. In the prior month, the index recorded a reading of 108.7 while markets expected it to drop to a level of 107.5. Moreover, the Ifo business expectations index declined to a level of 102.2 in July, lower than market expectations of a fall to a level of 101.6 and following a reading of 103.1 in the preceding month. On the other hand, the current assessment index unexpectedly rose to a level of 114.7 in July, compared to market expectations of a fall to a level of 114.0 and following a revised level of 114.6 in the previous month.

Macroeconomic data released in the US suggested that, the Dallas Fed manufacturing business index fell less-than-anticipated to a level of -1.3 in July, thus showing some signs of recovery, compared to a drop of -18.3 recorded in the previous month whereas markets expected it to fall to a level of -10.0.

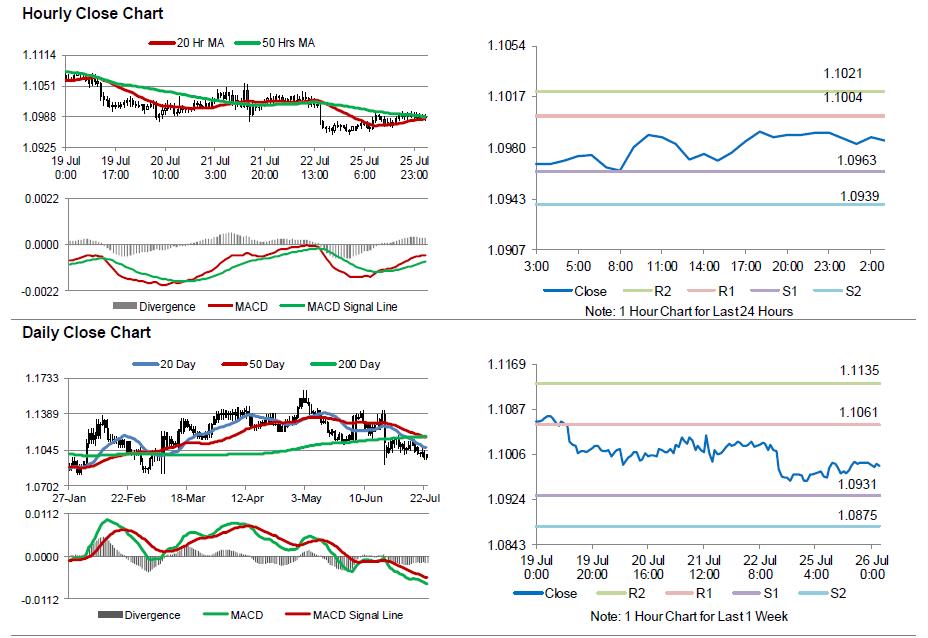

In the Asian session, at GMT0300, the pair is trading at 1.0986, with the EUR trading marginally lower against the USD from yesterday’s close.

The pair is expected to find support at 1.0963, and a fall through could take it to the next support level of 1.0939. The pair is expected to find its first resistance at 1.1004, and a rise through could take it to the next resistance level of 1.1021.

Moving ahead, investors will look forward to the US consumer confidence index, flash Markit services PMI and new home sales data, all slated to release later in the day.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.