For the 24 hours to 23:00 GMT, the EUR rose 0.17% against the USD and closed at 1.0747.

Yesterday, data indicated that German business sentiment deteriorated in January, amid mounting fears about the US President, Donald Trump’s protectionist comments.

The Ifo business expectations index in Germany unexpectedly dropped to a level of 103.2 in January, declining to a five-month low level and defying market expectations for the index to rise to a level of 105.8. In the previous month, the index registered a reading of 105.6. Additionally, the nation’s Ifo business climate index surprisingly fell to a level of 109.8 in January, confounding market expectations of an advance to a level of 111.3 and following a reading of 111.0 in the previous month. However, the nation’s Ifo current assessment index climbed to a level of 116.9 in January, in line with market expectations and compared to a reading of 116.6 in the previous month.

In the US, data revealed that the housing price index rose more-than-anticipated by 0.5% on a monthly basis in November, following a revised rise of 0.3% in the prior month and compared to market expectation for an advance of 0.3%. Moreover, the nation’s MBA mortgage applications climbed 4.0% in the week ended 20 January 2017, hitting its highest level in more than seven-months and after registering a gain of 0.8% in the previous week.

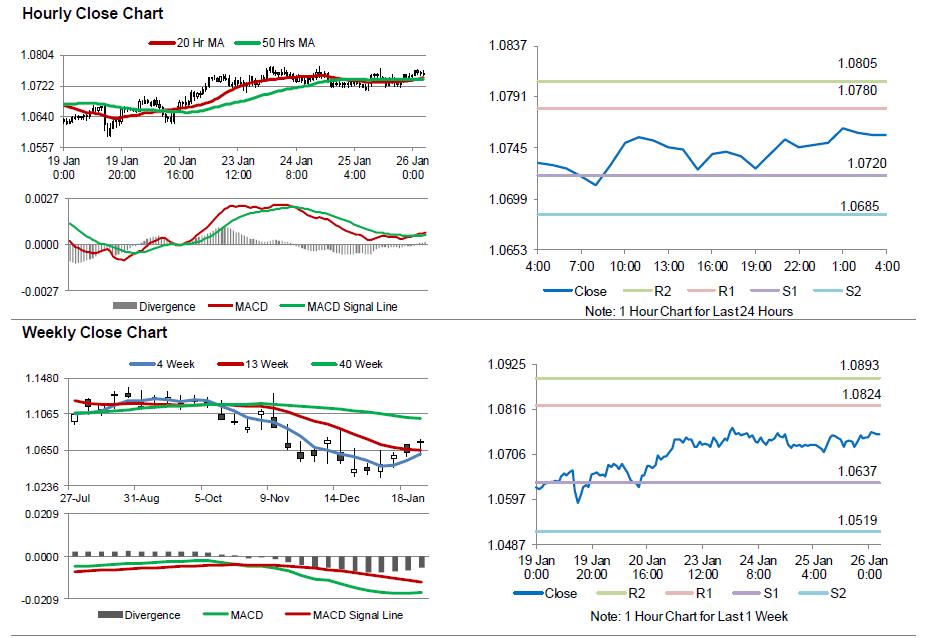

In the Asian session, at GMT0400, the pair is trading at 1.0756, with the EUR trading 0.08% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.0720, and a fall through could take it to the next support level of 1.0685. The pair is expected to find its first resistance at 1.0780, and a rise through could take it to the next resistance level of 1.0805.

Moving ahead, market participants look forward to Germany’s GfK consumer confidence index for February, scheduled to release in some time. Additionally, a raft of economic releases in the US, consisting of Markit services PMI for January, along with advance goods trade balance, wholesale inventories, CB leading indicator and new home sales, all for December, scheduled to release later in the day, will keep investors on their toes.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.