For the 24 hours to 23:00 GMT, the EUR declined 0.64% against the USD and closed at 1.1628, pressured by prospects of fresh elections in Italy and Spain.

On Friday, data indicated that Germany’s Ifo business climate index remained steady at a revised level of 102.2 in May, defying market expectations for a fall to a level of 102.0. Additionally, the nation’s Ifo current assessment index unexpectedly climbed to a level of 106.0 in May, from a revised reading of 105.8 in the previous month, while markets had anticipated a fall to a level of 105.5.

On the contrary, the nation’s Ifo business expectations index declined to a level of 98.5 in May, in line with market expectations and after recording a reading of 98.7 in the prior month.

The US Dollar gained ground against a basket of major currencies, after the US President, Donald Trump, renewed hopes of a US-North Korea summit.

Separately, data released on Friday showed that preliminary durable goods orders in the US slid more-than-anticipated by 1.7% on a monthly basis in April, amid weaker demand for aircraft. Market participants had envisaged durable goods orders to fall 1.3%, after registering a revised rise of 2.6% in the previous month. Furthermore, the nation’s final Reuters/Michigan consumer sentiment index fell to a level of 98.0 in May, compared to a reading of 98.8 in the preceding month. The preliminary print had indicated a steady reading.

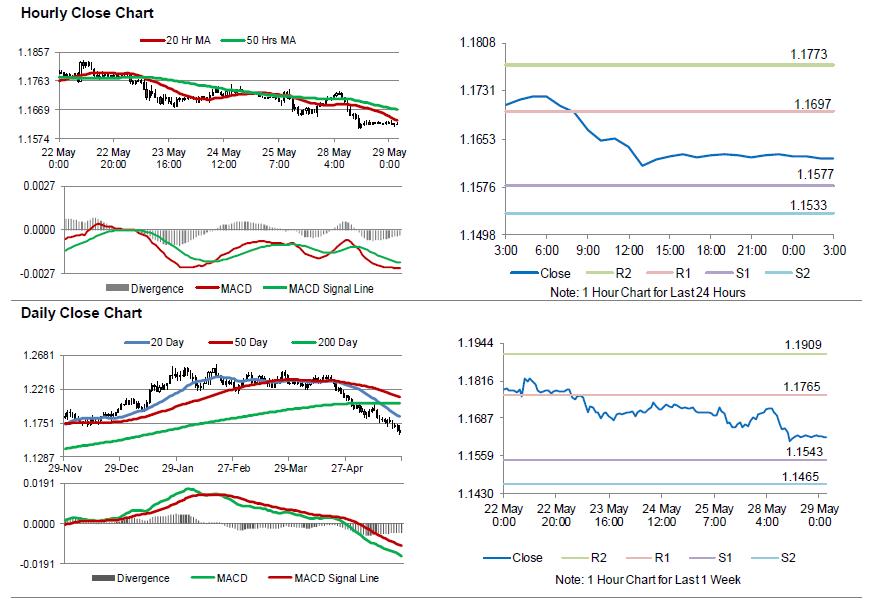

In the Asian session, at GMT0300, the pair is trading at 1.1622, with the EUR trading 0.05% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.1577, and a fall through could take it to the next support level of 1.1533. The pair is expected to find its first resistance at 1.1697, and a rise through could take it to the next resistance level of 1.1773.

Amid no key macroeconomic releases in the Euro-zone today, traders would focus on the US CB consumer confidence index for May, set to release later in the day.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.