For the 24 hours to 23:00 GMT, the EUR rose 0.07% against the USD and closed at 1.1975, after data showed that Germany’s GfK consumer confidence index surprisingly jumped to a nearly sixteen-year high level of 10.9 in September, while markets expected the index to remain steady at a level of 10.8 registered in the previous month.

Macroeconomic data released in the US indicated that the CB consumer confidence index rose more-than-expected to a level of 122.9 in August, notching a five-month high level, as a healthy job market and optimism about current business conditions boosted investor sentiment. Meanwhile, market participants had envisaged the index to advance to a level of 120.7, following a revised reading of 120.0 in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.1976, with the EUR trading a tad higher against the USD from yesterday’s close.

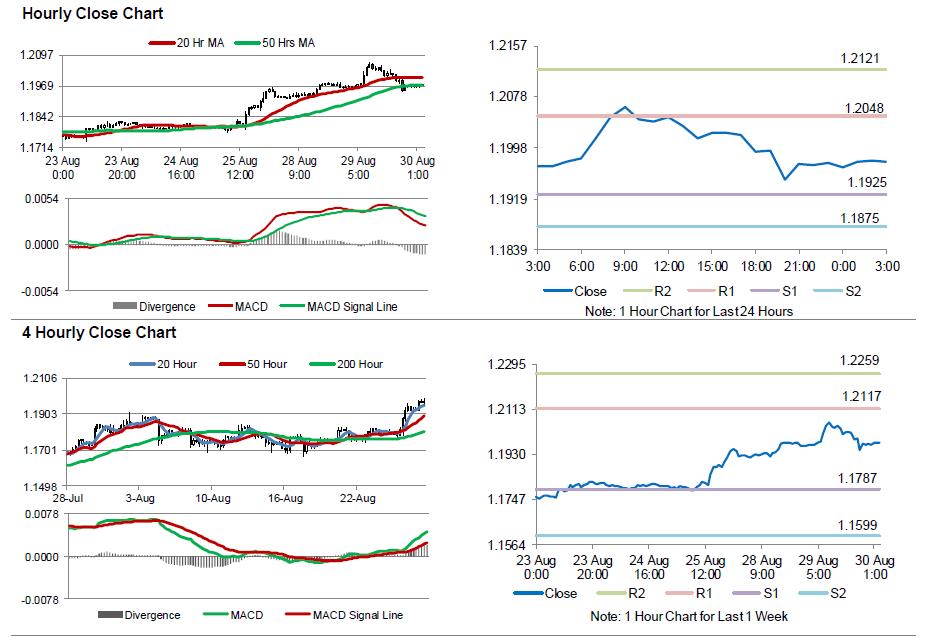

The pair is expected to find support at 1.1925, and a fall through could take it to the next support level of 1.1875. The pair is expected to find its first resistance at 1.2048, and a rise through could take it to the next resistance level of 1.2121.

Moving ahead, traders will look forward to the Euro-zone’s final consumer confidence and Germany’s flash consumer price inflation data, both for August, slated to release in a few hours. Moreover, the US 2Q annualised GDP and ADP employment change data for August, slated to release later today, will keep investors on their toes.

The currency pair is trading below its 20 Hr moving average and showing convergence with its 50 Hr moving average.