For the 24 hours to 23:00 GMT, the EUR declined 0.39% against the USD and closed at 1.1683.

In economic news, Germany’s GfK consumer confidence index unexpectedly climbed to a level of 10.8 in August, escalating to a sixteen-year high level, as strong economic growth in the nation continued to brighten investor sentiment. Market participants had expected the index to remain steady at a level of 10.6.

The greenback gained ground against its key peers, after data indicated that the US preliminary durable goods orders jumped 6.5% in June, accelerating at its fastest pace in nearly 3 years, propelled by robust demand for civilian aircraft. Durable goods orders had registered a revised drop of 0.1% in the prior month, while markets were expecting it to gain 3.9%. Further, the nation’s advance goods trade deficit narrowed more-than-expected to a level of $63.9 billion in June, amid a rise in exports and a decline in imports. Investors had envisaged advance goods trade deficit to narrow to a level of $65.5 billion, following a revised deficit of $66.3 billion in the previous month. Additionally, the nation’s seasonally adjusted flash wholesale inventories rose more-than-anticipated by 0.6% in June, compared to a rise of 0.4% in the prior month.

In other economic news, the number of Americans filing for fresh jobless claims climbed to a level of 244.0K in the week ended 22 July 2017, surpassing market expectations for a rise to a level of 240.0K. In the preceding week, initial jobless claims had recorded a revised reading of 234.0K. Meanwhile, the Chicago Fed national activity index rose less-than-expected to a level of 0.13 in June, after recording a revised reading of -0.30 in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.1691, with the EUR trading 0.07% higher against the USD from yesterday’s close.

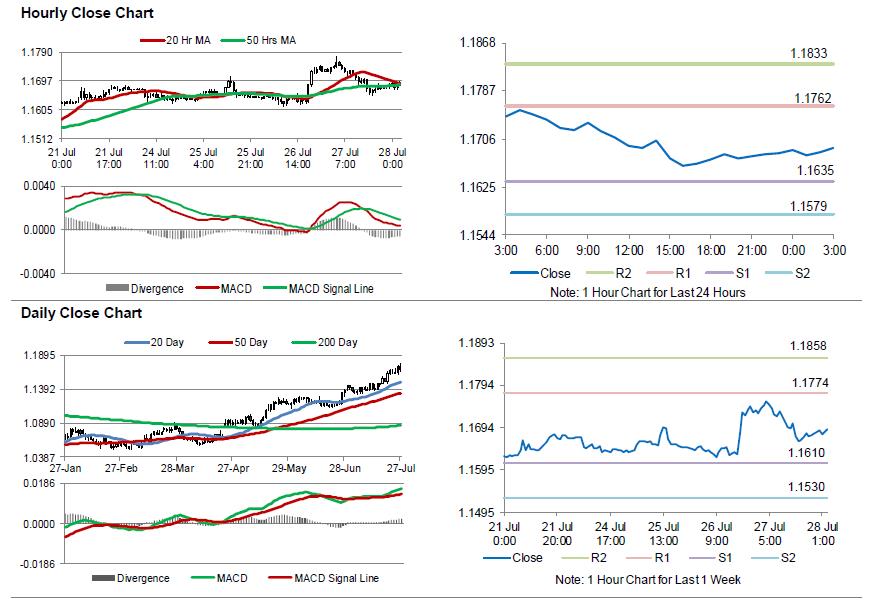

The pair is expected to find support at 1.1635, and a fall through could take it to the next support level of 1.1579. The pair is expected to find its first resistance at 1.1762, and a rise through could take it to the next resistance level of 1.1833.

Moving ahead, investors will closely monitor Germany’s flash inflation figures and the Euro-zone’s final consumer confidence data, both for July, slated to release in a few hours. Moreover, the US flash 2Q GDP report and final Michigan consumer confidence data for July, both due to release later today, will grab a lot of market attention.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.