For the 24 hours to 23:00 GMT, the EUR declined 0.25% against the USD and closed at 1.1142, after the release of downbeat ZEW survey data across the Euro-zone.

Data showed that, Euro-zone’s ZEW economic sentiment survey index fell to a 15-month low level of 13.6 in February, compared to a reading of 22.7 in the previous month. Additionally, Germany’s economic sentiment index dropped to a level of 1.0 in February, falling to its lowest level in sixteen-months, led by fears about the global economic slowdown and tumbling oil prices. Market participants expected the index to remain flat, compared to a reading of 10.2 in the previous month. Moreover, the nation’s ZEW current situation index eased to a level of 52.3 in February, lower than market expectations of a decline to a level of 55.0, from a reading of 59.7 in the preceding month.

In the US, the NAHB housing market index fell more-than-expected to a nine-month low level of 58.0 in February, compared to a revised level of 61.0 in the previous month while analysts anticipated it to fall to a level of 60.0.

Separately, the Philadelphia Fed President, Patrick Harker, indicated that the US Federal Reserve should wait until inflation picks up at a more robust pace before raising interest rates again.

In the Asian session, at GMT0400, the pair is trading at 1.1155, with the EUR trading 0.12% higher from yesterday’s close.

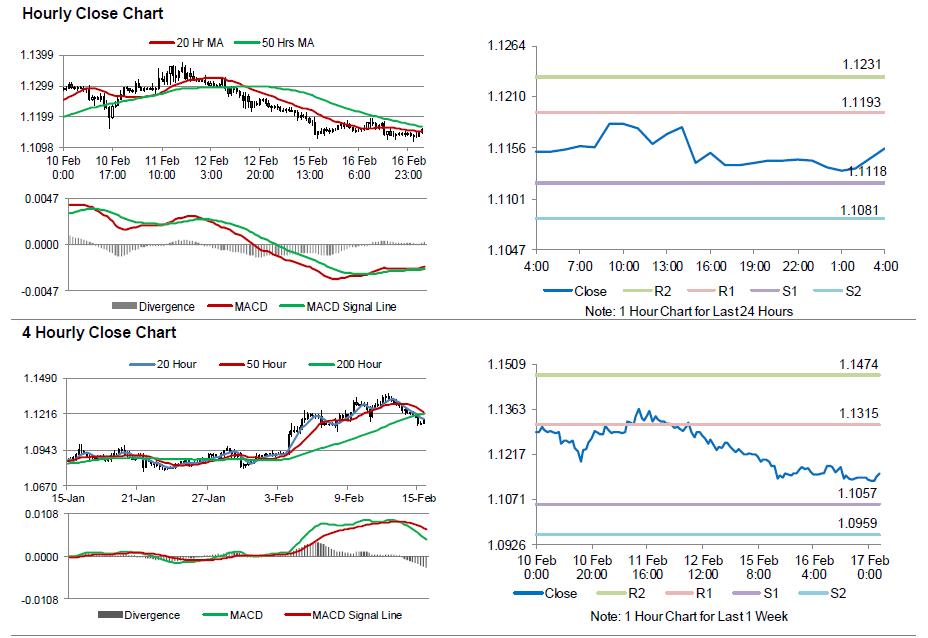

The pair is expected to find support at 1.1118, and a fall through could take it to the next support level of 1.1081. The pair is expected to find its first resistance at 1.1193, and a rise through could take it to the next resistance level of 1.1231.

Looking ahead, investors await the release of Euro-zone’s seasonally adjusted construction output and trade balance data, slated to be released in a few hours. Additionally, in the US, the FOMC minutes, housing starts and industrial production data, due for release later today, will also grab a lot of market attention.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.