For the 24 hours to 23:00 GMT, the EUR rose 0.41% against the USD and closed at 1.1681.

On Friday, Germany’s seasonally adjusted final gross domestic product (GDP) advanced 0.5% on a quarterly basis in 2Q 2018, at par with market expectations and confirming preliminary figures. In the previous quarter, GDP had registered a rise of 0.3%.

In the macro news, data showed that, Germany’s Ifo business climate index rose to a level of 103.8 in August, marking its highest level since February 2018 and compared to a reading of 101.7 in the previous month. Market expectation was for the index to climb to 101.8. Additionally, the nation’s Ifo current assessment unexpectedly jumped to a 5-month high level of 106.4 in August, compared to a revised level of 105.4 in the prior month. Moreover, the Ifo business expectations index registered a rise to 101.2 in August, marking its highest score since January and compared to a reading of 98.2 in the prior month.

The US dollar declined against basket of currencies, following the news of US-Mexico trade pact.

Separately, in the US, data on Friday indicated that, US preliminary durable goods orders slid 1.7% on monthly basis in July, compared to a rise of 0.8% in the prior month. Markets had expected the durable goods orders to fall 1.0%.

Meanwhile, the nation’s Chicago Fed national activity index a dropped to a level of 0.13 in July, compared to a revised level of 0.48 in the prior month. Market participants had envisaged the index to ease to a level of 0.45. On the other hand, the Dallas Fed manufacturing business index fell to a level of 30.9 in August. In the previous month, the index had registered a level of 32.3.

In the Asian session, at GMT0300, the pair is trading at 1.1677, with the EUR trading slightly lower against the USD from yesterday’s close.

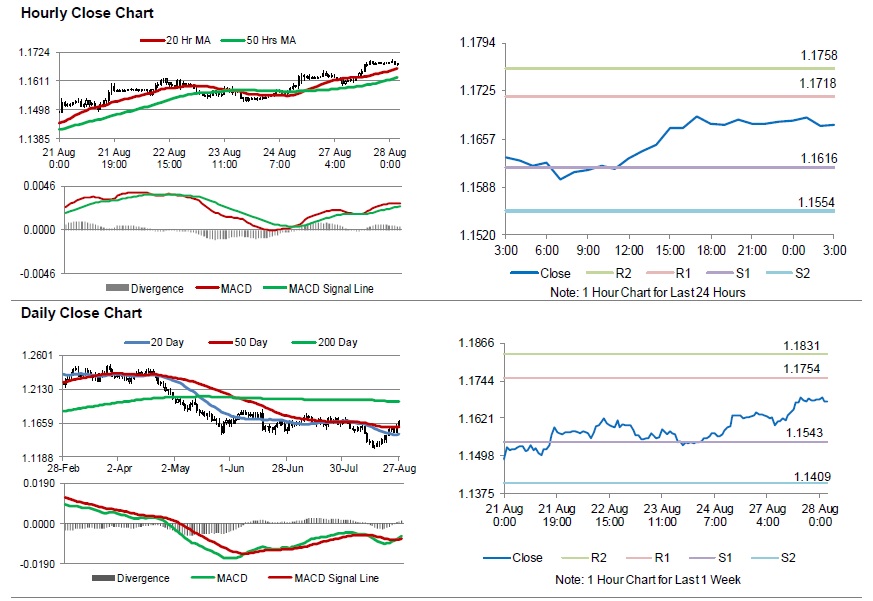

The pair is expected to find support at 1.1616, and a fall through could take it to the next support level of 1.1554. The pair is expected to find its first resistance at 1.1718, and a rise through could take it to the next resistance level of 1.1758.

Moving ahead, investors will await Germany’s retail sales data for July, set to release in a while. Later in the day, US advance goods trade balance for July, followed by the Richmond Fed manufacturing index and the consumer confidence, both for August, will pique significant amount of trader’s attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.