For the 24 hours to 23:00 GMT, the EUR declined 0.32% against the USD and closed at 1.1740.

Data indicated that Germany’s seasonally adjusted flash gross domestic product (GDP) advanced 0.6% on a quarterly basis in the second quarter of 2017, as households and state authorities increased their spending and companies boosted investment. However, market participants had envisaged the nation’s GDP to climb 0.7%, compared to a revised rise of 0.7% in the prior quarter.

The US Dollar nudged higher against its key peers, lifted by upbeat US economic data.

Data showed that advance retail sales in the US climbed more-than-expected by 0.6% in July, posting its sharpest increase in seven months and suggesting that consumer spending was off to a good start in the third quarter. Market participants had expected advance retail sales to gain 0.3%, after recording a revised increase of 0.3% in the previous month. Further, the nation’s New York Empire State manufacturing index jumped to a level of 25.2 in August, notching its highest level since September 2014 and beating market expectations of a rise to a level of 10.0. In the previous month, the index had registered a reading of 9.8. Moreover, the nation’s business inventories surged to a seven-month high, after it advanced 0.5% in June, surpassing market expectations for a rise of 0.4%. In the previous month, business inventories had risen 0.3%.

Other economic data showed that the US NAHB housing market index recorded an unexpected rise to a level of 68.0 in August, confounding market expectations for the index to remain steady at a level of 64.0. Also, the nation’s import price index rose 0.1% MoM in July, meeting market expectations. In the previous month, the index had registered a drop of 0.2%. Also, the nation’s export price index rebounded above expectations by 0.4% MoM in July, compared to a drop of 0.2% in the previous month.

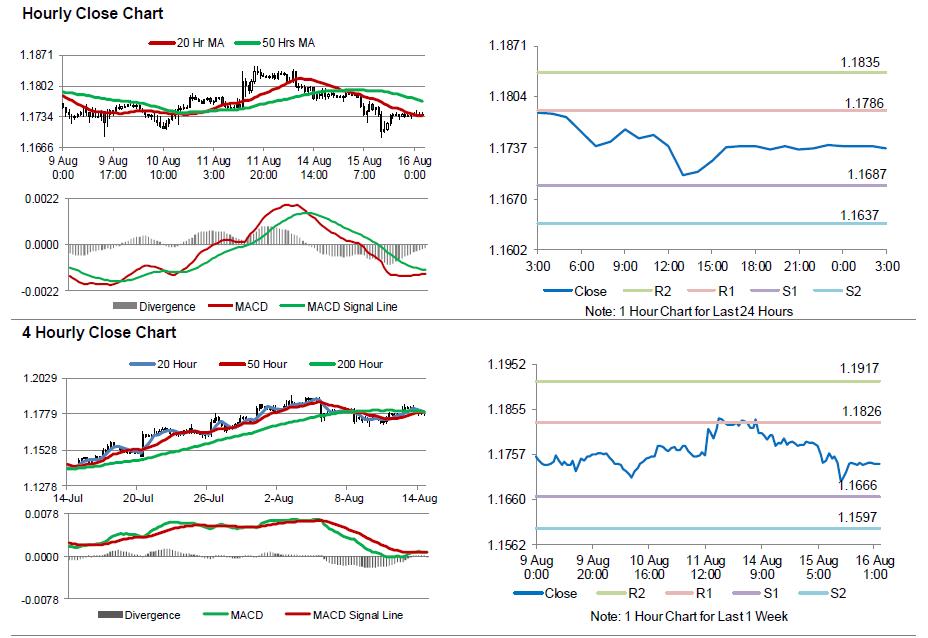

In the Asian session, at GMT0300, the pair is trading at 1.1736, with the EUR trading a tad lower against the USD from yesterday’s close.

The pair is expected to find support at 1.1687, and a fall through could take it to the next support level of 1.1637. The pair is expected to find its first resistance at 1.1786, and a rise through could take it to the next resistance level of 1.1835.

Moving ahead, investors will keep a close watch on the Euro-zone’s flash 2Q GDP numbers, slated to release in a few hours, to gauge strength in the European economy. Additionally, in the US, the FOMC July meeting minutes coupled with the nation’s housing starts and building permits data, both for July, all scheduled to release later in the day, will be closely watched by investors.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.