For the 24 hours to 23:00 GMT, the EUR rose 0.02% against the USD and closed at 1.1069.

According to the Bundesbank monthly report, Germany’s economy will rebound in the third quarter of this year after facing potential risks from Britain’s decision to leave the European Union, as the underlying economic trend remains on a solid footing and economic output is expected to show a sharp increase during the summer quarter.

In the US, the NAHB housing market index unexpectedly dropped to a level of 59.0 in July, while markets expected it to remain steady at 60.0.

In the Asian session, at GMT0300, the pair is trading at 1.1072, with the EUR trading marginally higher against the USD from yesterday’s close.

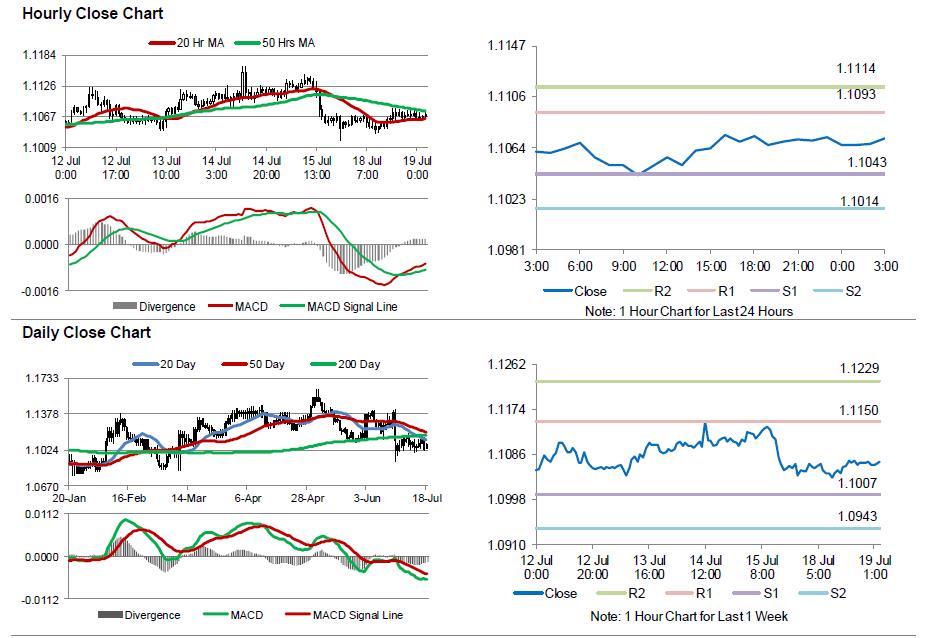

The pair is expected to find support at 1.1043, and a fall through could take it to the next support level of 1.1014. The pair is expected to find its first resistance at 1.1093, and a rise through could take it to the next resistance level of 1.1114.

Going ahead, market participants look forward to the release of ZEW survey data for July across the Euro-zone, due in a few hours. Additionally, housing starts and building permits data in the US, both for June, slated to release later in the day, will also attract a lot of market attention.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.