For the 24 hours to 23:00 GMT, the EUR declined 0.07% against the USD and closed at 1.1558, following disappointing German factory orders data.

Data showed that Germany’s seasonally adjusted factory orders retreated 4.0% on a monthly basis in June, registering its biggest fall since January 2017 and more than market expectations for a fall of 0.5%. In the previous month, factory orders had risen 2.6%.

On the contrary, in the Euro-zone, the Sentix investor confidence index jumped to a 3-month high level of 14.7 in August, amid easing concerns over EU-US trade war. The index had registered a level of 12.1 in the prior month, while market participants had envisaged for a climb to 13.4.

In the Asian session, at GMT0300, the pair is trading at 1.1559, with the EUR trading a tad higher against the USD from yesterday’s close.

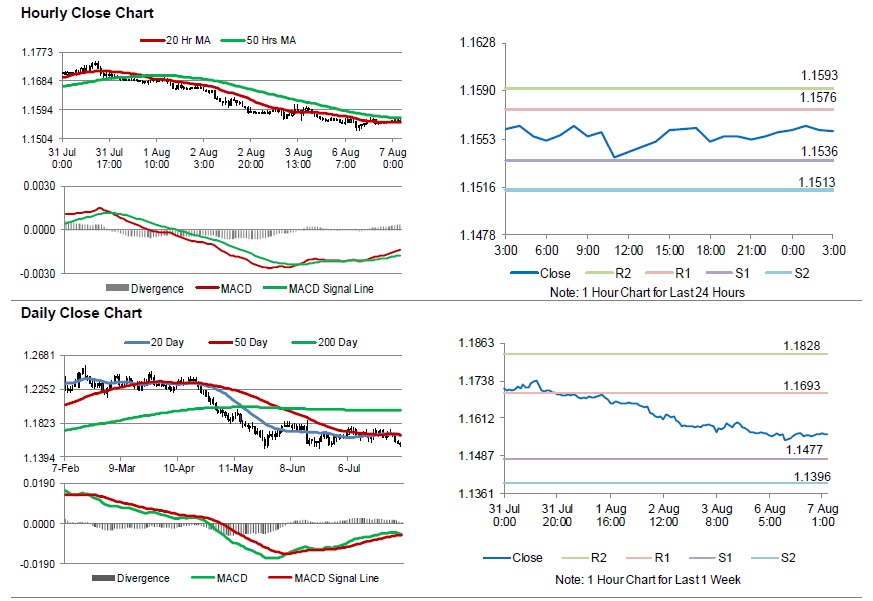

The pair is expected to find support at 1.1536, and a fall through could take it to the next support level of 1.1513. The pair is expected to find its first resistance at 1.1576, and a rise through could take it to the next resistance level of 1.1593.

Looking forward, traders will closely monitor Germany’s trade balance data and industrial production, both for June, set to release in a while. Later in the day, the US consumer credit data for June, will garner significant amount of investors’ attention.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.