For the 24 hours to 23:00 GMT, the EUR rose marginally against the USD and closed at 1.0556.

In economic news, data indicated that Germany’s seasonally adjusted final gross domestic product (GDP) climbed 0.2% on a quarterly basis in 3Q 2016, in line with the preliminary print, thus confirming that economic growth in the Euro-zone’s largest economy slowed in the third quarter, amid weak overseas trade. GDP had recorded a rise of 0.4% in the previous quarter. Further, the nation’s consumer confidence index unexpectedly edged higher to a level of 9.8 in December, defying market expectations for the index to remain steady at a level of 9.7, recorded in the previous month. On the other hand, the nation’s Ifo business expectations index unexpectedly eased to a level of 105.5 in November, compared to market expectations of a rise to a level of 106.0. In the prior month, the index had recorded a revised level of 105.9. Meanwhile, the nation’s Ifo business climate index surprisingly remained steady at a level of 110.4 in November, while market expected it to advance to a level of 110.5. On the contrary, the Ifo current assessment index unexpectedly rose to a level of 115.6 in November, compared to market expectations of a drop to a level of 115.0 and following a revised reading of 115.1 in the prior month.

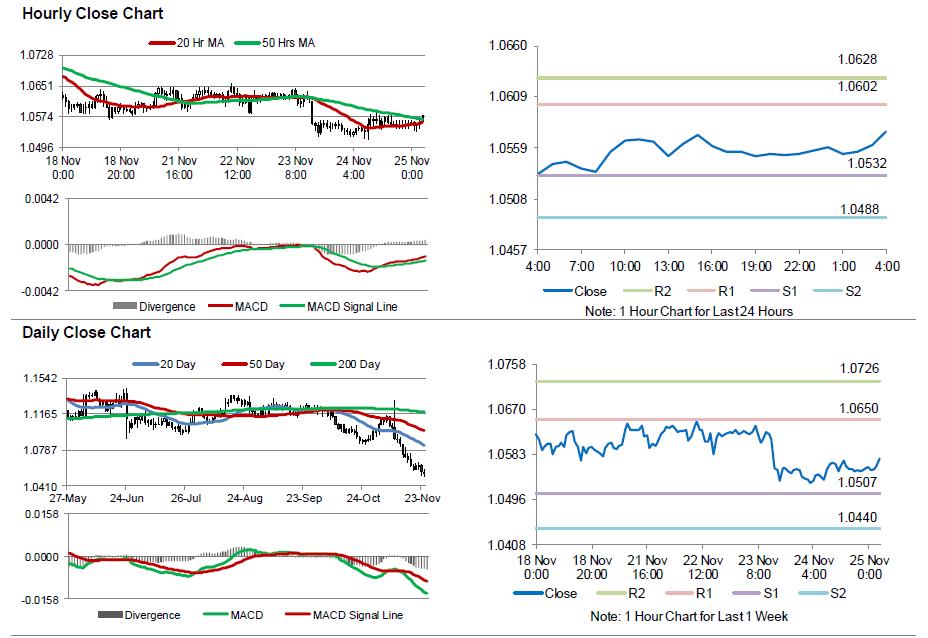

In the Asian session, at GMT0400, the pair is trading at 1.0575, with the EUR trading 0.18% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.0532, and a fall through could take it to the next support level of 1.0488. The pair is expected to find its first resistance at 1.0602, and a rise through could take it to the next resistance level of 1.0628.

With no major economic releases in the Euro-zone today, market participants would look forward to a speech by the ECB President, Mario Draghi along with the region’s consumer prices for November and German unemployment rate for November, slated to release next week. Meanwhile, the US goods trade balance for October and flash Markit services PMI for November, scheduled to release later in the day, would garner a lot of market attention.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.