For the 24 hours to 23:00 GMT, the EUR declined 0.11% against the USD and closed at 1.1857.

On Friday, data indicated that Germany’s GfK consumer confidence index recorded an unexpected rise to a level of 10.8 in January, highlighting that consumers grew optimistic over the country’s growth prospects in the new year. Market participants had expected the index to remain steady at a level of 10.7.

Macroeconomic data released in the US showed that the Dallas Fed manufacturing business index climbed to a more than eleven-year high level of 29.7 in December, beating market expectations for a rise to a level of 20.0. In the prior month, the index had registered a level of 19.4. On the other hand, the nation’s Richmond Fed manufacturing index declined more-than-anticipated to a level of 20.0 in December, compared to market consensus for a drop to a level of 21.0 and after recording a reading of 30.0 in the prior month.

On Friday, data revealed that the preliminary durable goods orders in US rebounded 1.3% in November, amid a jump in orders for civilian and defence aircraft. Durable goods orders had registered a drop of 0.8% in the previous month, while investors had envisaged for a rise of 2.0%. Moreover, the nation’s new home sales surged to a ten-year high level in November, after it advanced more-than-estimated by 17.5% on monthly basis to a level of 733.0K, compared to a revised level of 624.0K in the previous month. On the contrary, the nation’s final Reuters/Michigan consumer sentiment index dropped to a three-month low level of 95.9 in December, while the preliminary figures had recorded a fall to a level of 96.8. The index had posted a reading of 98.5 in the prior month.

Other data indicated that the nation’s personal spending jumped more-than-expected by 0.6% on a monthly basis in November, following a revised gain of 0.2% in the previous month, while markets were expecting for an increase of 0.5%. Meanwhile, the nation’s personal income climbed 0.3% in November, falling short of market expectations for an advance of 0.4%. In the previous month, personal income had registered a rise of 0.4%.

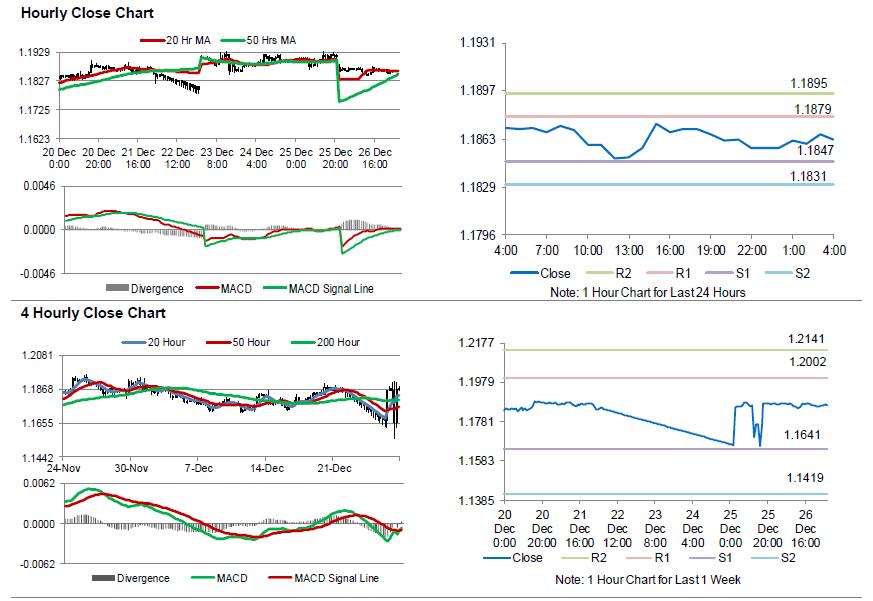

In the Asian session, at GMT0400, the pair is trading at 1.1863, with the EUR trading marginally higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1847, and a fall through could take it to the next support level of 1.1831. The pair is expected to find its first resistance at 1.1879, and a rise through could take it to the next resistance level of 1.1895.

Amid no macroeconomic releases in the Euro-zone today, traders would keep a close watch on the US consumer confidence index for December, followed by pending home sales data for November, both scheduled to release later in the day.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.